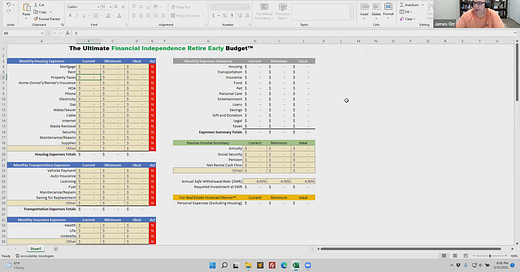

Use The Ultimate Financial Independence Retire Early (FIRE) Budget Spreadsheet to plan for your own financial independence and retiring early.

What’s similar to other budgeting spreadsheets?

What’s unique and different?

Similar to Other Budgets

First, just like other budgeting spreadsheets you can enter in your income and expenses for a variety of categories. There are even custom categories for less common expenses you might have.

Different Than Other Budgeting Spreadsheets

But there are a number of unique features for this spreadsheet that you won’t see in other spreadsheets.

Here are a few unique features/differences:

You’re really doing 3 budgets at the same time. One budget for what you’re currently spending. One budget for what you would be spending if you were living on your minimum required to be financially independent. And a third budget if you were living your ideal lifestyle and financially independent. By having 3 different amounts for expenses for each you can see how close you are to reaching your financial independence goals and where you are currently.

You can mark expenses as “actual” or “estimated”. Sometimes you want to see where you are and are OK estimated numbers until you have time to really go back and verify numbers are correct and “actual”. If you know a number is 100% correct, mark it “actual”. Otherwise, mark it estimated and you’ll easily be able to see which you need to verify and confirm later.

Get a summary of all your monthly expenses by category for each of your 3 budgets.

And, here’s where it gets really interesting…

Enter in how much you’re earning from various sources of passive income for each of your 3 budgets like annuities, social security, pensions, net rental property cash flow or any other passive income you’re receiving… then the spreadsheet will tell you how much you need to have invested in stocks/bonds to be financially independent and have your investments cover your expenses. Then, you can easily see how much more you need to save/invest to be financially free.

Adjust your estimated Safe Withdrawal Rate to see how changing your assumption impacts how much more you still need to save.

Plus, if you have an account on the Real Estate Financial Planner™ software, you can see what you should be using for your personal expenses when modeling your own portfolio and investing strategy.

License

This spreadsheet—and all the others on this website unless explicitly stated otherwise—is provided to current, active subscribers under the very limited Don’t Steal My Stuff license. Basically, you can use it for your own personal use only.

Spreadsheet Download

Download the latest version of The Ultimate FIRE Budget Spreadsheet below.

Listen to this episode with a 7-day free trial

Subscribe to Real Estate Financial Planner™ to listen to this post and get 7 days of free access to the full post archives.