Choosing an investor-friendly real estate agent is a crucial step in your real estate investing journey. The right agent will understand investment properties and help you find deals that match your specific goals.

Here’s how a good agent can assist you:

Strategy Selection - You’ll get insights into which investment strategies—such as buy-and-hold, fix-and-flip, or short-term rentals—work best in your local market based on current conditions.

Property Selection - An experienced agent can help you identify properties that align with your investment goals by considering factors like location, property type, and potential for value appreciation.

Rental Income Analysis - They can provide data on local rental rates and occupancy trends to help estimate your potential return on investment.

Appreciation Potential - Your agent can share market trends and historical data to identify areas with strong appreciation potential.

Market Trend Insights - You’ll stay informed about factors like population growth, economic developments, and zoning changes that could impact your investments.

The right agent will also help you navigate the buying or selling process effectively. Focus on finding someone who understands the nuances of real estate investing and is committed to helping you build your portfolio.

Secrets to Selecting an Investor-Friendly Real Estate Agent

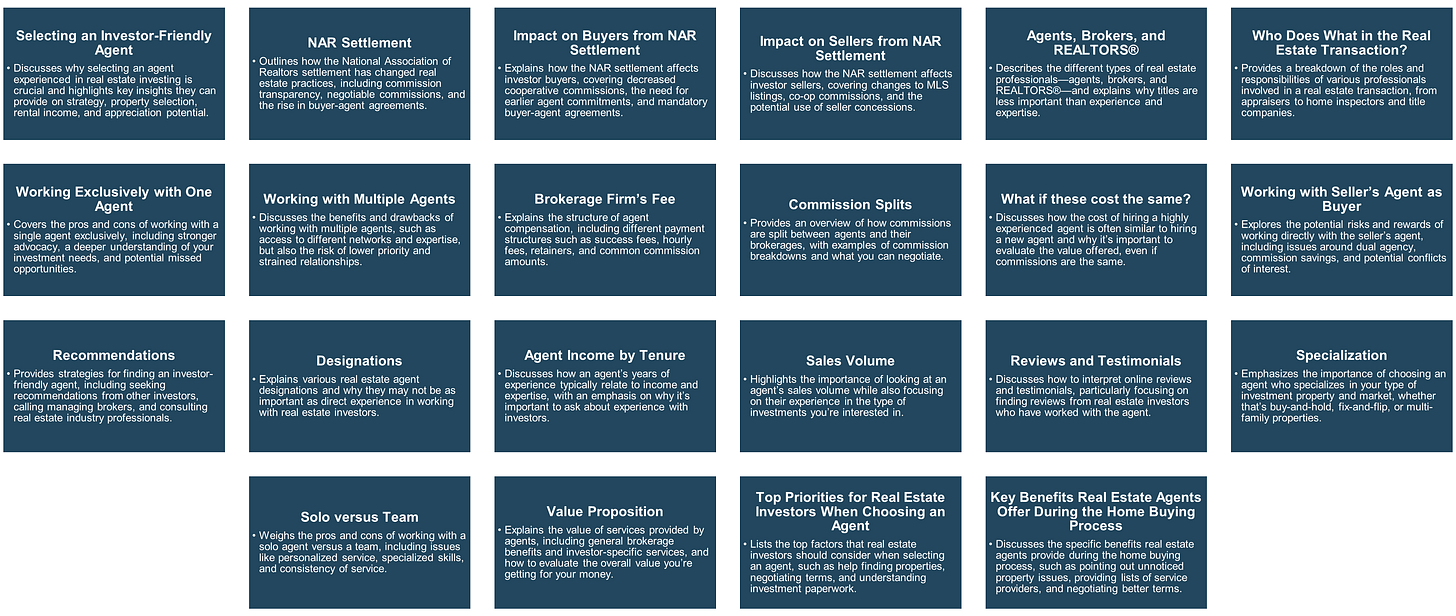

In this module (12 of 46 in the Real Estate Investing Secrets course), you will learn:

Table of Contents

Here’s what’s included in this bonus module:

Selecting an Investor-Friendly Agent - This section discusses why selecting an agent experienced in real estate investing is crucial and highlights key insights they can provide on strategy, property selection, rental income, and appreciation potential.

NAR Settlement - This section outlines how the National Association of Realtors settlement has changed real estate practices, including commission transparency, negotiable commissions, and the rise in buyer-agent agreements.

Impact on Buyers from NAR Settlement - Explains how the NAR settlement affects investor buyers, covering decreased cooperative commissions, the need for earlier agent commitments, and mandatory buyer-agent agreements.

Impact on Sellers from NAR Settlement - Discusses how the NAR settlement affects investor sellers, covering changes to MLS listings, co-op commissions, and the potential use of seller concessions.

Agents, Brokers, and REALTORS® - Describes the different types of real estate professionals—agents, brokers, and REALTORS®—and explains why titles are less important than experience and expertise.

Who Does What in the Real Estate Transaction? - Provides a breakdown of the roles and responsibilities of various professionals involved in a real estate transaction, from appraisers to home inspectors and title companies.

Working Exclusively with One Agent - Covers the pros and cons of working with a single agent exclusively, including stronger advocacy, a deeper understanding of your investment needs, and potential missed opportunities.

Working with Multiple Agents - Discusses the benefits and drawbacks of working with multiple agents, such as access to different networks and expertise, but also the risk of lower priority and strained relationships.

Brokerage Firm’s Fee - Explains the structure of agent compensation, including different payment structures such as success fees, hourly fees, retainers, and common commission amounts.

Commission Splits - Provides an overview of how commissions are split between agents and their brokerages, with examples of commission breakdowns and what you can negotiate.

What if these cost the same? - Discusses how the cost of hiring a highly experienced agent is often similar to hiring a new agent and why it’s important to evaluate the value offered, even if commissions are the same.

Working with Seller’s Agent as Buyer - Explores the potential risks and rewards of working directly with the seller’s agent, including issues around dual agency, commission savings, and potential conflicts of interest.

Recommendations - Provides strategies for finding an investor-friendly agent, including seeking recommendations from other investors, calling managing brokers, and consulting real estate industry professionals.

Designations - Explains various real estate agent designations and why they may not be as important as direct experience in working with real estate investors.

Agent Income by Tenure - Discusses how an agent’s years of experience typically relate to income and expertise, with an emphasis on why it’s important to ask about experience with investors.

Sales Volume - Highlights the importance of looking at an agent’s sales volume while also focusing on their experience in the type of investments you’re interested in.

Reviews and Testimonials - Discusses how to interpret online reviews and testimonials, particularly focusing on finding reviews from real estate investors who have worked with the agent.

Specialization - Emphasizes the importance of choosing an agent who specializes in your type of investment property and market, whether that’s buy-and-hold, fix-and-flip, or multi-family properties.

Solo versus Team - Weighs the pros and cons of working with a solo agent versus a team, including issues like personalized service, specialized skills, and consistency of service.

Value Proposition - Explains the value of services provided by agents, including general brokerage benefits and investor-specific services, and how to evaluate the overall value you’re getting for your money.

Top Priorities for Real Estate Investors When Choosing an Agent - Lists the top factors that real estate investors should consider when selecting an agent, such as help finding properties, negotiating terms, and understanding investment paperwork.

Key Benefits Real Estate Agents Offer During the Home Buying Process - Discusses the specific benefits real estate agents provide during the home buying process, such as pointing out unnoticed property issues, providing lists of service providers, and negotiating better terms.

NAR Settlement

Recent changes in the real estate industry, stemming from a settlement between the National Association of Realtors (NAR) and the U.S. Department of Justice, have impacted the way agents operate. As an investor, it’s important to understand how these changes may affect your experience when selecting an agent.

Key points to keep in mind:

Transparency in Commissions - There is now a greater emphasis on transparency in how real estate commissions are disclosed. You’ll have clearer information upfront about agent compensation.

Negotiable Commissions - While commissions have always been negotiable, this change highlights that fact even more. You may find additional flexibility when negotiating agent fees.

Buyer Agent Agreements - There may be an increase in the use of buyer agent agreements, outlining the terms of your relationship with your agent, including compensation.

Additionally, here are some core concepts to remember:

Agent Representation is Independent of Payment - Regardless of who pays the agent, their representation of either party remains separate from the payment arrangement. An agent can be paid by the seller or buyer while still representing either party.

Paperwork Defines Representation - The agreements you sign determine who represents whom and who pays whom. Always read and understand these documents before signing.

When selecting an agent, seek someone who can explain these changes clearly and how they might influence your real estate investment strategy. Look for transparency about fees, services, and how these new rules might shape your working relationship.

Impact on Buyers from NAR Settlement

The changes brought by the National Association of Realtors (NAR) settlement will impact investors looking to buy properties. Understanding these shifts is essential for navigating real estate transactions as an investor.

Here’s what you should be aware of:

Decreased Cooperative Commissions - You may notice fewer sellers offering cooperative commissions to buyer's agents, affecting how you negotiate and search for properties.

Increased Fee Negotiations - You'll need to be more proactive in negotiating fees with your buyer's agent. This gives you more control but requires a clear understanding of agent compensation and the services being offered.

Mandatory Buyer-Agent Agreements - Written agreements with your agent are now required before you tour properties. This is meant to increase transparency in your working relationship.

Specific Compensation Terms - Your agreement must clearly define the agent's compensation, ensuring no unexpected fees later. This requires careful review when drafting the terms.

Potential Additional Costs - If the seller’s offered commission is less than what you’ve agreed to pay your agent, you might need to cover the difference. Alternatively, you can focus on properties where the seller's commission offer aligns with your agreement.

Earlier Commitment to Agents - In the past, some agents required representation agreements only when making an offer. Now, you’ll likely need to sign much earlier in the process.

These changes emphasize the need for an investor-friendly agent who understands how to navigate this new landscape. Your agent should help you make informed decisions and guide you through these adjustments while keeping your investment goals in mind.

Although these changes may require some adaptation, they also provide opportunities for savvy investors to negotiate better terms and work more strategically in real estate transactions.

Impact on Sellers from NAR Settlement

Though you may be focused on buying properties, it’s helpful to understand how the NAR settlement impacts you as a potential seller. The settlement introduces significant changes to the selling process that could affect how you work with agents and market your properties.

Here’s what to keep in mind as a seller:

Co-op Commissions Still Allowed - You can still offer co-op commissions to buyer's agents, which may attract buyers who otherwise might not be able to pay their agent's fees out of pocket.

Changes in MLS Listings - The Multiple Listing Service (MLS) will no longer display co-op commission fields, so you’ll need to find alternative ways to communicate compensation offers to buyer's agents.

Alternative Marketing Strategies - You can still advertise co-op offers using methods like sign riders, print ads, or agent websites, although some restrictions apply.

Potential Use of Seller Concessions - Seller concessions may become a more common strategy, allowing buyers to indirectly pay their agent’s fees. However, this approach might face limitations with certain types of loans.

Increased Transaction Transparency - You may need to be more explicit about any compensation you’re offering to buyer's agents to ensure clarity in the transaction.

Impact on Buyer Pool - These changes could influence the types of buyers interested in your property. Some buyers may hesitate if they are unsure about agent compensation.

Importance of Agent Selection - It’s critical to choose an agent who understands how to navigate these changes while still developing effective selling strategies that attract qualified buyers and comply with the new regulations.

These adjustments highlight the need for an agent with strong expertise in both buying and selling investment properties, ensuring that you’re well-positioned in this evolving real estate environment.

Agents, Brokers, and REALTORS®

When selecting an investor-friendly agent, you’ll encounter three primary titles in the real estate industry: agent, broker, and REALTOR®. Understanding these distinctions can help you choose the right person for your investment strategy.

Here’s a breakdown of each role:

Real Estate Agent - A licensed professional who can help you buy, sell, or rent properties. Agents work under a broker and must complete state-required coursework and licensing exams.

Real Estate Broker - Brokers have additional qualifications and experience beyond agents. They can operate independently, manage their own brokerage, and supervise other agents.

REALTOR® - A real estate agent or broker who is a member of the National Association of REALTORS® (NAR). REALTORS® follow a strict code of ethics and have access to extra resources through NAR.

For simplicity, the term "agent" is commonly used to refer to all these roles unless there’s a need to make specific distinctions.

In some markets, you might also come across specialized variations of these titles:

Additional Variations in Titles

Broker-Associate - A licensed broker who works under another broker instead of running their own firm. They typically have more experience than a typical agent but don’t manage their own business.

Managing Broker - The head broker responsible for overseeing all the agents in a brokerage. They handle high-level decisions and ensure compliance with industry rules.

Associate Broker - A broker who works under a managing broker, offering more authority than an agent but not running their own brokerage.

Is One Title Better Than Another?

Titles aren’t as important as the agent’s experience, knowledge, and ability to help you achieve your investment goals. Instead of focusing on whether someone is a broker or REALTOR®, prioritize finding someone who knows investment properties and has a strong track record with real estate investors.

What truly matters is their expertise in working with investment strategies, their knowledge of the local market, and their ability to deliver results. Titles are secondary to finding an agent who can help you build your portfolio and meet your investment objectives.

Who Does What in the Real Estate Transaction?

When buying an investment property, it’s essential to understand who handles the different aspects of the transaction. While your real estate agent will play a key role, other professionals are also involved.

Here’s a breakdown of the various responsibilities:

Keep reading with a 7-day free trial

Subscribe to Real Estate Financial Planner™ to keep reading this post and get 7 days of free access to the full post archives.