Get access to the entire Casting Light on the Financing Secrets of Real Estate Investors course… just by mumbling maybe with a free trial.

In Casting Light on the Financing Secrets of Real Estate Investors you’ll learn about financing real estate investments.

In Part I: Financing Types you’ll learn about all the different financing types and options available for real estate investors.

In Part II: Getting Loans you’ll learn tips and strategies for getting loans.

In Part III: Private Mortgage Insurance you’ll learn all about Private Mortgage Insurance (PMI) and how it applies to real estate investors.

In Part IV: Leaving Soon we include some bonus classes that are available for a limited time.

Part I: Financing Types

The following modules cover all the different types of financing available to real estate investors.

Are FHA Loans for Suckers? - While FHA loans allow you invest in single family homes, duplexes, triplexes and fourplexes with as little as 3.5% down, the monthly PMI never goes away. So, are they loans for suckers? (55 minutes)

Conventional Financing 101 for Real Estate Investors - Everything you wanted to know about conventional financing for real estate investing. (30 minutes)

Portfolio Loans 101 for Real Estate Investors - Portfolio loans are a great option in some very specific situations. Learn more in this module. (22 minutes)

Commercial Loans 101 for Real Estate Investors - Financing more than 5 units is a special type of financing with additional limitations and some new downsides. (16 minutes)

Hard Money and Private Money for Real Estate Investors - Financing without going to banks? Learn all about it. (47 minutes)

Other Financing Options for Real Estate Investors - What about X or Y or Z? Find out other financing options for real estate investors in this special class. (41 minutes)

Part II: Getting Loans

The following modules cover tips and strategies for getting loans as a real estate investor.

Selecting a Lender for Real Estate Investors - What might you consider when selecting which lender to use? (21 minutes)

The Importance of Loan Planning for Real Estate Investors - Understand the importance of loan planning before you start getting loans or pay the price later. (26 minutes)

Buying Down Mortgage Interest Rates for Real Estate Investors - Improve your mortgage interest rate and therefore your cash flow. (45 minutes)

Loan Comparison Spreadsheet for Real Estate Investors - Compare a variety of mortgage products on one downloadable/editable spreadsheet in this special class. (19 minutes)

Preparing to Get Mortgages - What do you need to do to be prepared to get a mortgage? (29 minutes)

Tips for Getting Mortgage Quotes from Lenders - If you’re going to call around to shop the best rates and terms from a number of lenders, here are some tips for doing that and improving your cash flow. (32 minutes)

Financing Tips When Writing an Offer to Buy a Rental - What should you be doing when writing an offer that specifically relates to getting your financing? (17 minutes)

Part III: Private Mortgage Insurance

The following modules covers private mortgage insurance (PMI) for real estate investors.

FHA Mortgage Insurance Premiums - Learn all about PMI payments when putting 3.5% down with FHA financing as investors. (20 minutes)

What is PMI And How to Avoid It? - Private Mortgage Insurance basics and how to easily avoid having to pay it. (19 minutes)

What Affects Your PMI Rate - Learn all the factors that go into private mortgage insurance rates and what you can do to minimize your PMI and maximize cash flow on your rentals. (14 minutes)

The 3 Strategies to Pay PMI - Learn the different options you have for paying for private mortgage insurance. (28 minutes)

How to Calculate PMI - Learn exactly how to calculate private mortgage insurance and—more importantly—why you probably shouldn’t calculate it yourself. (11 minutes)

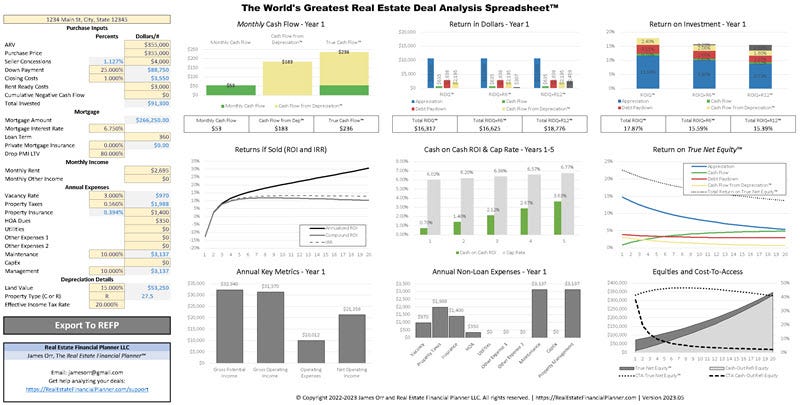

How to Analyze Deals with PMI - Learn how to analyze deals with private mortgage insurance using The World’s Greatest Real Estate Deal Analysis Spreadsheet™ (download available). (10 minutes)

Private Mortgage Insurance Myths - What’s true and what’s a myth regarding PMI? (25 minutes)

How Return on Investment Changes Based on Credit Score With PMI - See the impact of your credit score—including its impact on PMI—on your return on investment calculations. (40 minutes)

Tax Deductibility of PMI Payments - Is private mortgage insurance tax deductible? Find out in this special class. (12 minutes)

How Return on Investment Changes Based on How You Pay PMI (27 minutes)

Part IV: Leaving Soon

The following bonus classes are available for a limited time as bonus content.

The Ultimate Guide to VA Loans - Learn all about VA loans for real estate investors that are also veterans. (79 minutes)

Unleashing the Secret Power of Debt-To-Income for Real Estate Investors - DTI is used to both qualify you for a loan and to measure riskiness in your investment portfolio. Learn all about it in this class. (108 minutes)

Evaluating Mortgages and Comparing Lenders - Trying to compare quotes from different lenders is near impossible… this class will help you make sense of it all. (119 minutes)

Real Estate Investor Loan Comparison Deep Dive - A special class comparing a variety of real estate investor loans. (112 minutes)

Buying Down Interest Rates with Brian Williams and special spreadsheet (109 minutes)

$997 Value… But Included Free

The Casting Light on the Financing Secrets of Real Estate Investors course is available for purchase separately for $997, but you can get access by simply mumbling maybe with a free trial.

Keep reading with a 7-day free trial

Subscribe to Real Estate Financial Planner™ to keep reading this post and get 7 days of free access to the full post archives.