If you’re looking to buy a rental property in the next 90 days… while prices are high, interest rates are high (and seem to be rising every day) and rents are lagging… then it is more important than ever to truly understand the impact of buying properties with lackluster cash flow.

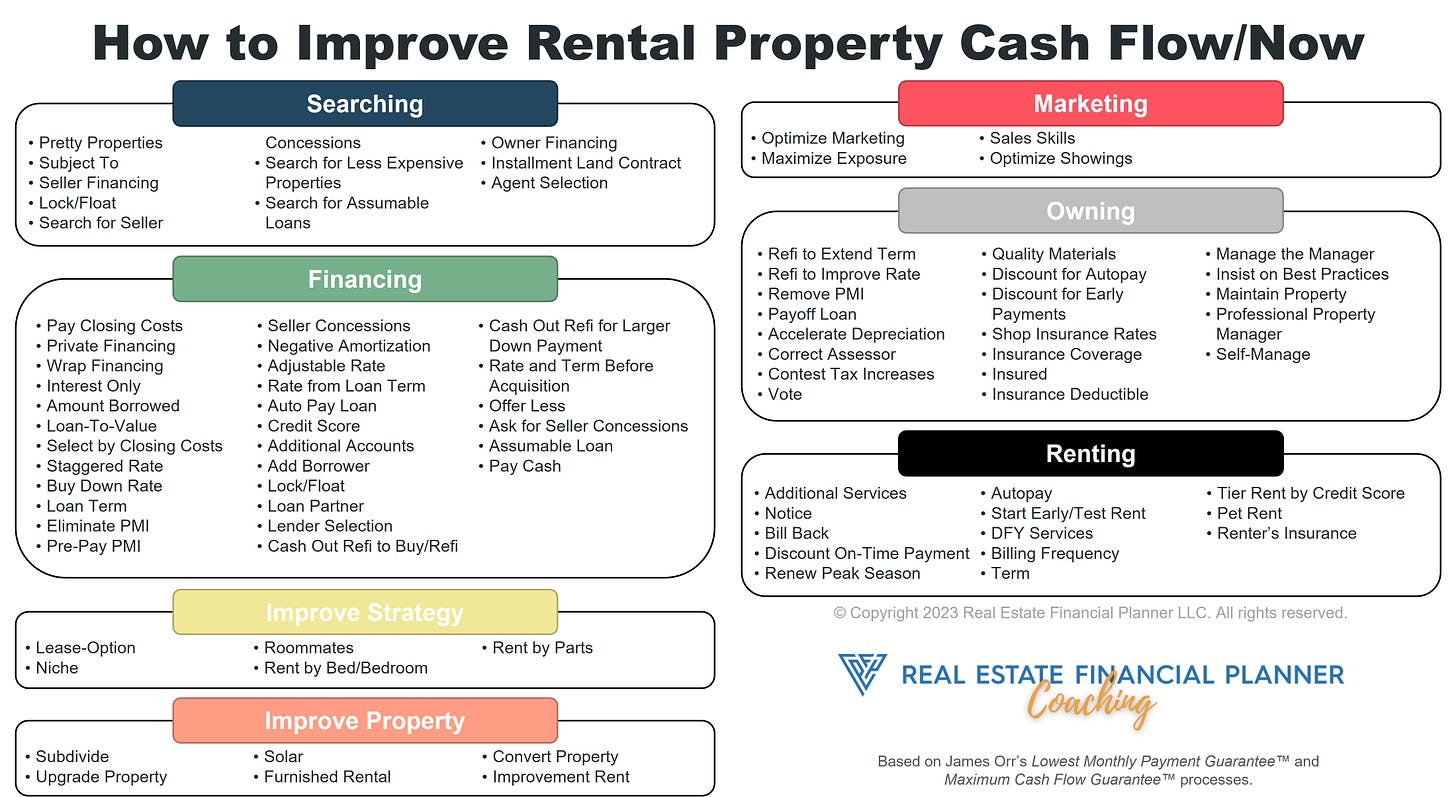

Even if you use the 88 different strategies we have for massively improving cash flow and speeding up your ability to be financially independent, debt-to-income might be a real obstacle to you reaching your goal.

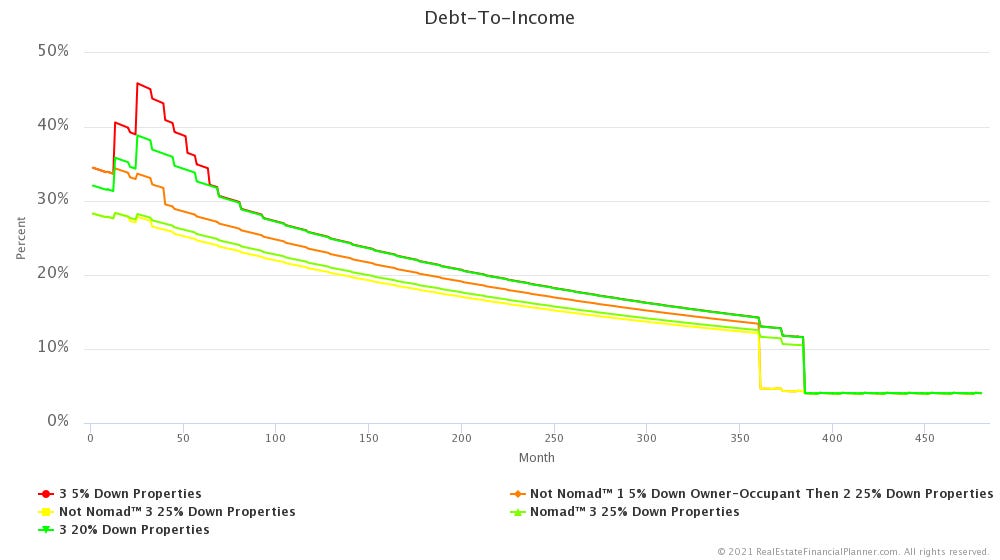

Debt-To-Income is a calculation done—usually by lenders—to qualify you for your next purchase.

Having great positive cash flowing properties can help your debt-to-income and make it easier to qualify for the next loan. Buying yucky cash flowing properties can hurt you and slow down your acquisitions with traditional financing.

Knowing what is and isn’t included in the calculation and how they handle a positive cash flowing property and a negative cash flowing property (they’re handled differently) can help you plan and make sure the plan you’ve selected will get you to financial independence fastest and safest with the highest standard of living once you get there.

Watch the almost 2-hour video on Unleashing the Secret Power of Debt-To-Income for Real Estate Investors below for paid substack subscribers or in the coaching platform for coaching clients.

Keep reading with a 7-day free trial

Subscribe to Real Estate Financial Planner™ to keep reading this post and get 7 days of free access to the full post archives.