In the last few years, we’ve seen equity explode.

Property prices have been growing like a weed in a weed spring.

And, lower mortgage interest rates means loan paydown has been more like the Mississippi than a backyard creek.

Many real estate investors who owned property through that period will be tempted to tap that equity to invest in more properties… leverage up.

But, leveraging up is not without risk.

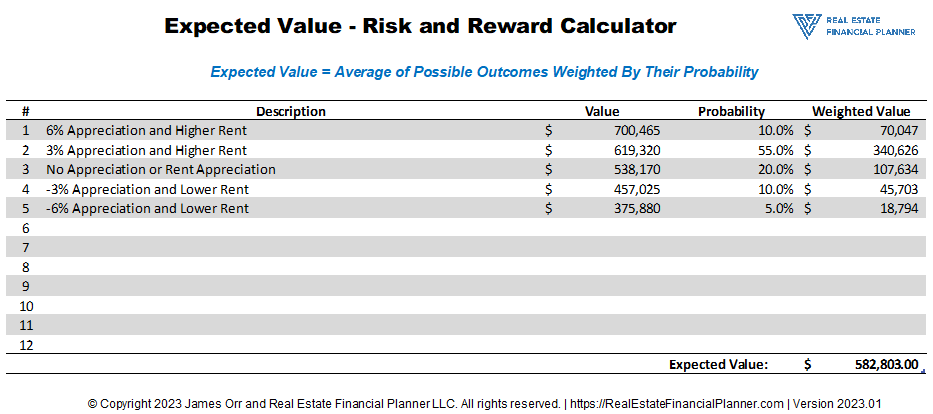

In this special class, James demonstrates how risk changes as you leverage up and much more using the concept of expected value and his new spreadsheet.

Enjoy!

Love,

James Orr

License

This spreadsheet—and all the others on this website unless explicitly stated otherwise—is provided to current, active subscribers under the very limited Don’t Steal My Stuff license. Basically, you can use it for your own personal use only.

Spreadsheet Download

Download the latest version of the EV - Risk and Reward spreadsheet below.

Watch with a 7-day free trial

Subscribe to Real Estate Financial Planner™ to watch this video and get 7 days of free access to the full post archives.