Refinancing can be one of the most powerful financial tools in your real estate investment strategy—when you know how to use it effectively.

In this book, we’re diving into what refinancing really means, the types of refinancing options available, and when it makes sense to consider refinancing your rental property. You’ll learn about key metrics like return on equity, cash flow impact, and risk management strategies to help you make informed decisions.

We’ll walk through different scenarios, from reducing your monthly payments to cashing out for new investments, and we’ll explore both common and uncommon methods to analyze your potential returns before and after refinancing. Along the way, you’ll gain a solid understanding of how refinancing can align with your goals for financial independence, liquidity, and portfolio growth.

While some calculations may overlap with decisions about selling a property, refinancing brings its own unique considerations. If you're interested in exploring those distinctions, you can find more detailed guidance in our companion book and spreadsheet, Should I Sell My Rental Property? Let’s get started with the foundational knowledge you’ll need to master refinancing as a strategic advantage in your investment journey.

Table of Contents

Included below:

Should I Refinance My Rental Property?

What Does It Mean to Refinance?

Why Refinancing Matters for Real Estate Investors

Types of Refinancing

Reasons to Consider Refinancing

Common Refinance Limits

Typical Costs Associated with Refinancing

Common and Uncommon Analysis

Calculating Your Break-Even Point

Common Rules of Thumb for Refis

Risks and Drawbacks of Refinancing

Refinancing Creatively Financed Deals

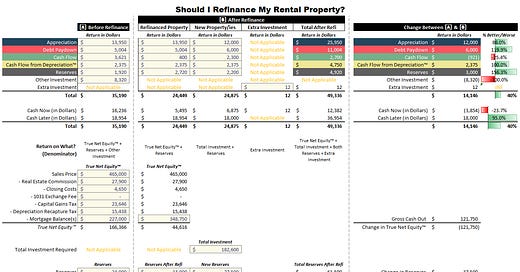

Using Spreadsheets to Analyze Returns Before and After Refinance - including our advanced Should I Refinance My Rental Property? spreadsheet download.

Before and After in Dollars

Different Types of Returns: Not All Are Created Equal

Return in Dollars Versus Return on Investment

True Net Equity™

Total Investment Required

Reserves

Other Investment

Refi Loan-To-Value

Cost of Refi

Before and After Return on Amount Invested

Not Buying Additional Properties

Buying Down Your Mortgage Interest Rate When Refinancing

Refinancing When Rates Are Higher

Refinancing and Asset Protection

What Does It Mean to Refinance?

Refinancing a rental property means replacing your existing mortgage with a new one, typically with different terms. The new loan pays off the balance on your current mortgage, and you begin repaying under the new terms. This can involve changing the interest rate, adjusting the length of the loan term, or even taking cash out if the property has built up significant equity.

The goal of refinancing is to optimize your financial position—whether by lowering monthly payments, freeing up cash for new investments, or managing debt more effectively within your real estate portfolio.

Why Refinancing Matters for Real Estate Investors

Refinancing is a powerful tool for real estate investors because it allows you to actively use your equity to improve returns rather than letting it sit passively in the property. Over time, your property’s return on equity (ROE) tends to decrease, even as returns from appreciation, cash flow, debt paydown, and other areas grow in absolute dollar amounts.

Here’s why ROE declines as your property matures. As you hold a property over many years, you pay down the loan, its value appreciates, and your equity grows. While this equity is beneficial, it doesn’t always work as efficiently as it could.

By refinancing, you can unlock some of that equity to keep it working for you. Let’s look at how different return factors grow over time and why they often lag behind the growth in equity.

Appreciation - As your property appreciates, the dollar amount of appreciation tends to increase each year if we assume a consistent rate (such as 3%). This means the value of the appreciation grows over time. However, since your equity usually grows faster than the appreciation in dollar terms, the appreciation as a percentage of your total equity tends to drop.

Cash Flow - Cash flow generally improves over time because rents tend to increase, while the mortgage payment stays fixed with a fixed-rate loan. Even if expenses like property taxes, insurance, and maintenance increase at the same rate as rents, your cash flow still tends to grow because rent is typically a larger number than these expenses. However, the rate at which cash flow improves is usually slower than the rate at which your equity grows, which gradually reduces your ROE.

Debt Paydown - As you continue to make mortgage payments, you pay down more principal each year, which helps increase your equity. While debt paydown grows in absolute dollar value, the percentage return on your growing equity from debt paydown declines over time.

Cash Flow from Depreciation™ - For 27.5 years, the IRS allows you to take a consistent depreciation deduction on residential rental properties, providing tax benefits that improve cash flow. Although this dollar amount remains fixed during that period, your equity in the property continues to grow, which means the return on equity (ROE) from depreciation gradually declines. After 27.5 years, the depreciation deduction goes to zero, causing this source of return to disappear entirely and further lowering your ROE.

Reserves - If you hold a certain number of months’ worth of reserves, this reserve amount may grow as expenses increase, but it rarely keeps pace with the property’s equity growth. This slower growth in reserve requirements versus equity also means a shrinking ROE over time.

In the end, although returns from appreciation, cash flow, debt paydown, and reserves generally improve in dollar amounts over time—and depreciation remains fixed—these returns are typically outpaced by the property’s growing equity. This results in a decreasing return on equity (ROE) over time. Refinancing can be a valuable strategy to access this idle equity and reinvest it in ways that keep your returns strong and efficient across your portfolio.

Types of Refinancing

There are two main types of refinancing for rental properties: rate-and-term and cash-out refinancing. Each serves different goals, so it’s important to understand how each one works and when it might align with your investment strategy.

Rate-and-Term Refinance - Also known as a limited cash-out refinance, a rate-and-term refinance is primarily aimed at obtaining better loan terms, such as a lower interest rate, a different loan duration, or removing mortgage insurance. You may also increase the loan balance slightly to cover closing costs or prepaid expenses, allowing you to refinance with minimal cash out of pocket. Additionally, you can receive a small amount of cash back—typically limited to the lesser of 2% of the new loan amount or $2,000, per lender guidelines. For example, if you’re refinancing an existing balance of $200,000 and your closing costs are $5,000, you could add the $5,000 to your loan and receive up to $2,000 cash back, resulting in a total new loan amount of $207,000. This type of refinance is typically used when the goal is to improve cash flow or adjust the loan term without substantially increasing your loan balance.

Cash-Out Refinance - A cash-out refinance allows you to access a portion of your property’s equity by taking out a new loan larger than your existing mortgage balance. The extra funds beyond your current mortgage can be used for various purposes, such as reinvesting in new properties, funding property improvements, or consolidating debt. With a cash-out refinance, you can increase your loan balance significantly, up to a maximum loan-to-value (LTV) ratio as allowed by the lender. Investors typically consider cash-out refinancing when they want to leverage their property’s equity for additional investments or other strategic financial moves.

Choosing between these options depends on your goals: rate-and-term refinances are best for optimizing loan terms, while cash-out refinances provide access to equity for reinvestment or other financial uses.

Reasons to Consider Refinancing

There are many strategic reasons to refinance your rental property. Refinancing can help you strengthen cash flow, reduce risk, increase liquidity, and improve your portfolio’s overall returns. Here are some key reasons why investors often choose to refinance:

Lowering Your Interest Rate - Securing a lower interest rate can significantly reduce your loan costs over time and often improves cash flow, especially if it’s a substantial rate reduction. Lower interest payments free up funds for reinvestment or reserves, which strengthens your overall financial position.

Reducing Monthly Payments - Refinancing to a lower rate or extending the loan term can reduce your monthly mortgage payments. This can boost cash flow on the property and provide more funds for other investments or reserves, allowing for a more comfortable financial buffer.

Cash-Out for New Investments - Cash-out refinancing lets you access equity in your property to fund new investment opportunities. Many investors use cash-out proceeds to buy additional properties, expanding their portfolios without using personal savings.

Shortening or Extending Loan Term - Adjusting the loan term to a shorter period can help pay off the property sooner, reducing total interest costs. Alternatively, extending the term can lower monthly payments, improving cash flow if that’s the primary goal.

Debt Consolidation and Credit Improvement - Cash-out refinances can help you pay down higher-interest debts, which can improve your debt-to-income (DTI) ratio and credit score. This, in turn, could allow you to qualify for better financing terms on future property purchases.

Funding Property Improvements - Cash-out refinancing can provide funds for property improvements or upgrades that may increase rental income or boost the property’s value. Furnishing a property to turn it into a short-term rental, for example, can often significantly improve cash flow.

Reducing Risk with Fixed vs. Adjustable Rates - Refinancing from an adjustable-rate mortgage to a fixed-rate mortgage can provide stability by protecting you from potential interest rate hikes. Fixed-rate loans lock in your monthly payments, reducing uncertainty and helping you plan for the long term.

Increasing Cash Reserves and Liquidity - Cash-out refinancing can also be used to increase cash reserves, which improves liquidity. Having more accessible funds reduces financial risk, providing a safety net for unexpected repairs, vacancies, or economic downturns.

Optimizing Return on Equity - As equity grows, your return on equity (ROE) often decreases. Refinancing allows you to pull out some of that equity and reinvest it, which can lead to a higher overall return on your investment capital.

Achieving Financial Independence - Refinancing can help you accelerate your journey to financial independence by unlocking capital to create additional income streams. You might use funds to pay off another rental property to improve cash flow, invest in stocks or bonds with a safe withdrawal rate, or purchase an annuity for steady income.

Supplementing Down Payments for Other Properties - Cash-out refinancing can provide funds to cover down payments on other properties, helping you avoid private mortgage insurance (PMI) by reaching a 20% down payment. This allows you to expand your portfolio without paying PMI, which improves your cash flow.

Buying Down Mortgage Rates on New Properties - Cash-out refinancing can also fund rate buydowns on new property loans. Lower rates on these loans improve your cash flow across your portfolio and enhance your overall returns.

Generating Capital for Lending Opportunities - Refinancing can free up capital to participate as a hard money lender or an investment partner in other real estate deals. This diversifies your income streams and can generate higher returns outside of direct ownership.

Freeing Up Loan Spots for New Purchases - Sometimes, refinancing allows you to pay off a smaller mortgage on another property in full, freeing up a loan spot and enabling you to qualify for additional 30-year fixed-rate financing on new acquisitions.

Improving Asset Allocation - Refinancing can be a way to shift funds from one asset class (like equity in rental properties) into another, such as stocks, bonds, or other investments. This can diversify your portfolio and improve its resilience to market changes.

Funding Marketing and Acquisition Costs - Investors sometimes refinance to pull out cash to fund marketing efforts, down payments, and closing costs for creatively financed deals. Having accessible cash for these costs enables you to take advantage of more flexible financing structures in new acquisitions.

Supporting the BRRRR Strategy - The BRRRR (Buy, Rehab, Rent, Refinance, Repeat) strategy relies on refinancing after a property has been improved to recoup your investment. By refinancing, you can pull out the capital invested in the property’s rehab and use it to fund your next BRRRR project, enabling you to expand your portfolio without additional cash injections.

Each of these reasons can add value to your investment strategy, but the best refinancing option depends on your specific goals, property performance, and long-term financial plan.

Common Refinance Limits

Refinancing a rental property comes with several limitations that vary by loan type, lender, and specific program guidelines. Here’s a look at the most common refinance limits you’ll encounter with both rate-and-term and cash-out refinancing.

Keep reading with a 7-day free trial

Subscribe to Real Estate Financial Planner™ to keep reading this post and get 7 days of free access to the full post archives.