Setting Up Modeling Assumptions & Stocks in Various Inflation Environments

Part 2 of Inflation for Real Estate Investors

This series is an EXPANDED VERSION of the new book I just published called Inflation for Real Estate Investors.

Setting Up the Modeling Assumptions

We’ll start with my assumptions for creating the models.

These are the baseline assumptions used to simulate how different scenarios may play out over time.

Annual Paying Subscribers to this substack get access to the Real Estate Financial Planner™ software to be able to change these assumptions to closer match your personal situation.

Email me if you don’t have access to this included perk.

Understanding these assumptions is key to interpreting the results, as they set the stage for modeling a real estate investor’s path to financial independence.

Modeled for 720 Months (60 Years) - The models span a 60-year period to capture long-term trends and fluctuations.

3% Inflation Rate - We've chosen a 3% annual inflation rate as our starting point. This figure closely reflects the historical average and provides a solid baseline for our analysis. It's important to note that this rate is a key variable we'll be adjusting to examine how the same investment strategy performs under different inflationary conditions.

4% Yearly Safe Withdrawal Rate (SWR) - The safe withdrawal rate represents the annual percentage of a retirement portfolio that can be withdrawn without likely depleting the balance over a long period.

$10,000 Minimum Target Monthly Income in Retirement (MTMIR) in Today's Dollars/Definition of Financial Independence - Financial independence is defined as having a minimum target monthly income of $10,000 in today’s dollars from investments. This income would come from net cash flow generated by rental properties and from applying the yearly safe withdrawal rate to any amount invested in stocks. Since this target is adjusted upward with inflation, they will often need more than $10,000—sometimes significantly more—depending on how long it takes to reach financial independence. This approach ensures a consistent lifestyle with equivalent buying power, despite changes in inflation over time.

$100,000 Starting Account Balance Earning 9.9% Yearly Rate of Return (At Start) - The initial balance for each scenario is $100,000, invested in stocks. The assumed annual rate of return is 9.9%, reflecting the historical average of the S&P 500 from 1928 to December 21, 2023. This rate will be used for any funds kept in stocks, including money that real estate investors have waiting to deploy into buying properties. It’s worth noting that the relationship between stock market returns and inflation is imperfect. There have been periods when the stock market has underperformed during high inflation and times when it has thrived during similar conditions. This recent period of high inflation, for example, saw strong stock market performance.

Monthly Income Assumption for Renters - I assume that in scenarios where people are renting, their combined annual income is $120,000, with each earning $60,000 per year. This translates to an hourly wage of $30 for a standard 40-hour workweek (2,000 hours per year). If they work a full-time job plus a part-time job totaling 60 hours per week (3,000 hours per year), their hourly rate drops to $20. We assume that their income increases with inflation over time. However, in reality, maintaining or increasing their income may require taking on more responsibilities or changing jobs, as wages at the same job may not always keep up with inflation. Returning to the open job market often results in wage increases that match—or even exceed—inflation rates, providing necessary boosts to their earning power.

Monthly Expenses - The assumed monthly expenses, including taxes, are $9,000. This leaves a savings rate of 10%, or approximately $1,000 per month.

Home Purchase Assumption (5% Down) - For scenarios where the individuals are buying an owner-occupant home with 5% down, it’s assumed that their monthly savings decrease slightly. This is because buying with just 5% down and Private Mortgage Insurance (PMI) often leads to slightly higher initial costs compared to renting. More on those assumptions when we talk about them buying a property.

These assumptions create a framework to analyze different paths to financial independence for real estate investors, comparing stock market investments, real estate purchases, and other strategies under varying inflation conditions.

Investing in Stocks

Let’s start simple and build up to more complex models.

Paid subscribers (monthly or annual) click here to see ALL and ANY of the related charts for this first scenario.

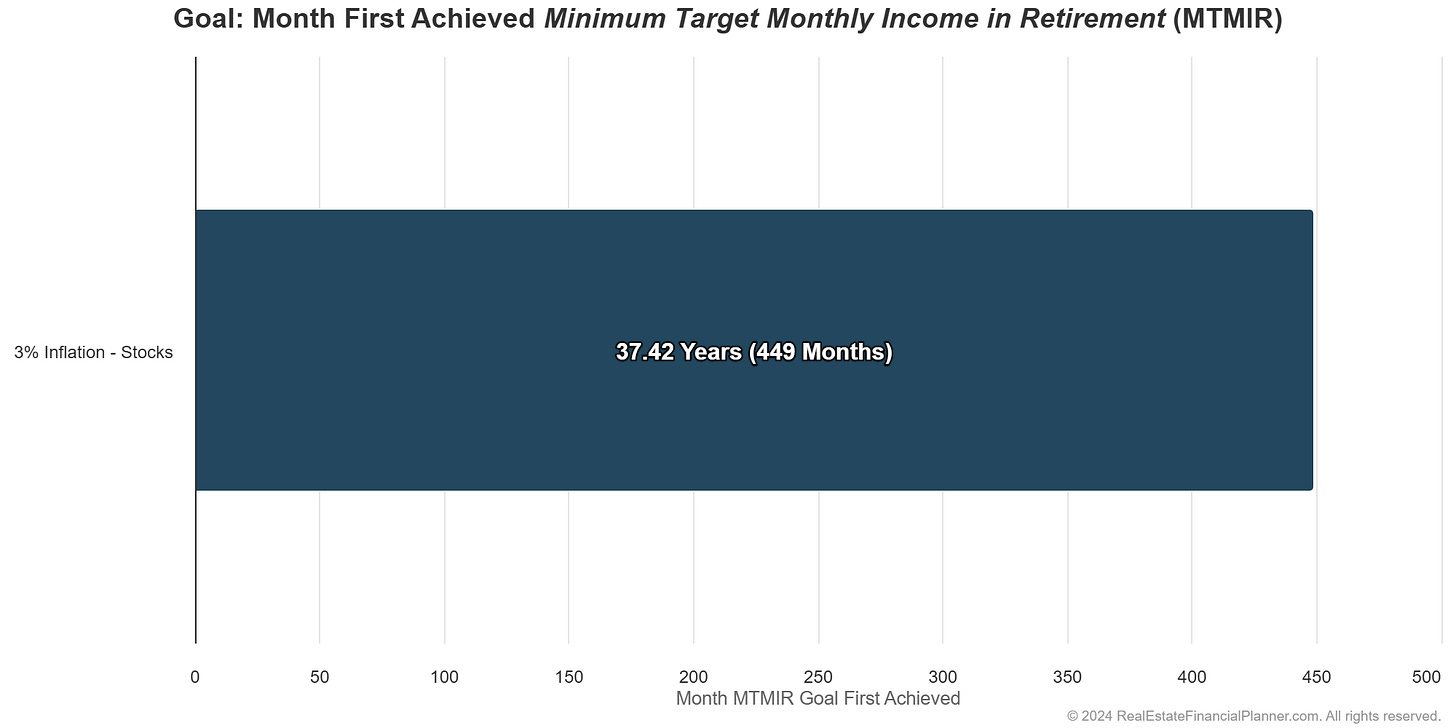

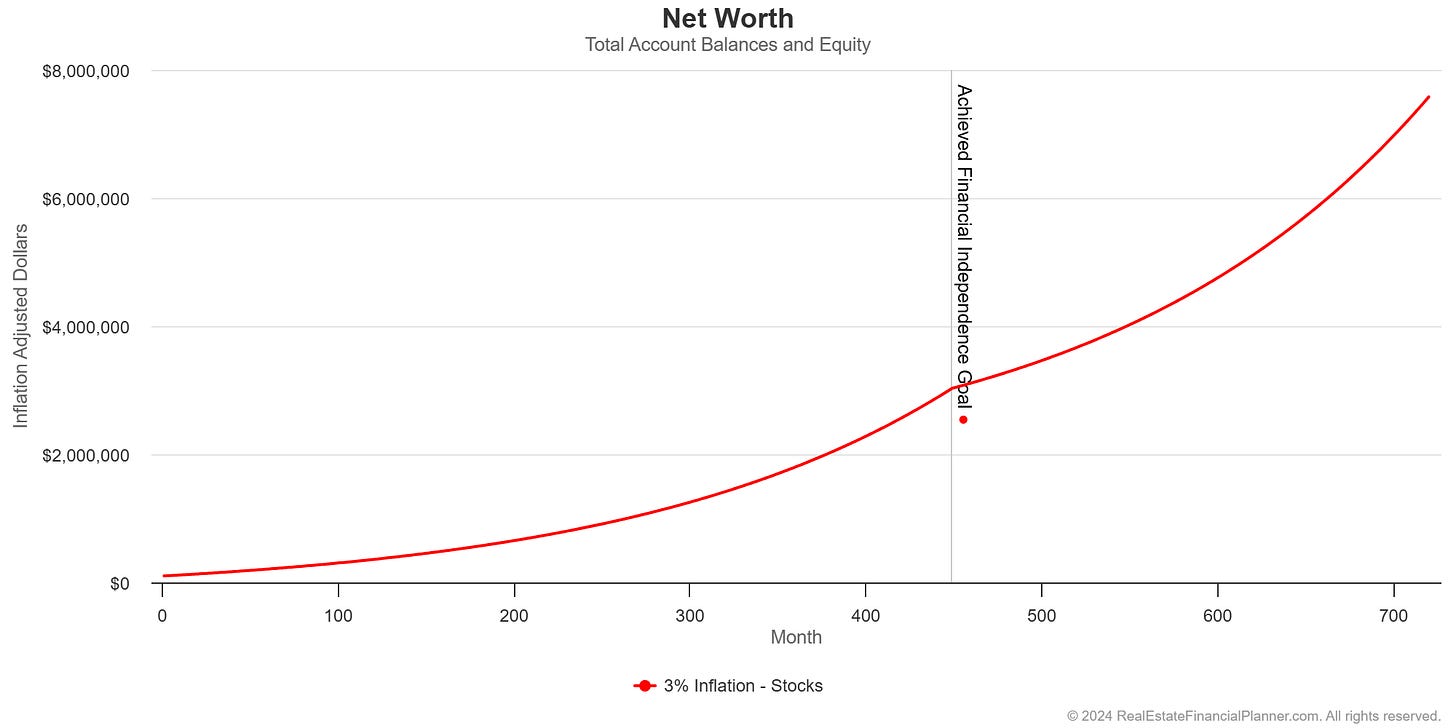

If these folks—with the assumptions above—save 10% of their income in stocks earning 9.9% per year in a 3% inflation environment, they would be financially independent in 37.42 years as shown in Figure 3 and Figure 4.

At that point, a 4% safe withdrawal rate from the amount they have invested in stocks would be enough to provide them with $10,000 per month in income adjusted up from inflation.

They’d have over $9 million dollars in future, inflated dollars after 449 months. See Figure 5.

If we adjust back to today’s dollars, it really feels like they have just over $3 million dollars as shown in Figure 6.

If inflation was at the Feds target of just 2% per year for the entire 60-year modeling period, they’d achieve financial independence faster as seen in Figure 7. How much faster?

Keep reading with a 7-day free trial

Subscribe to Real Estate Financial Planner™ to keep reading this post and get 7 days of free access to the full post archives.