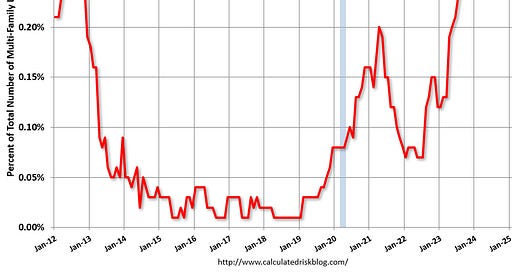

Multi-Family Delinquency Rates

Why Variable Rate Mortgages, Balloons and Periodic Financial Reviews Can Hurt Real Estate Investors and What To Do About It Instead

I’m often wrong. But, one thing I think I’ve been right about is my preference for 30-year, fixed-rate, fully amortizing (no balloon) financing on rental properties.

Sure, there are times when the deal is so good that you feel compelled to take on less-than-ideal financing on a property.

Make sure that your reserves are so flush and cash flow is so strong to minimize the chance of you experiencing a financing crunch from the far less desirable financing on many multi-family properties with their:

Variable interest rates,

Balloons and

Periodic financial reviews

It is no surprise to me that with a massive rise in property prices over the last decade, a serious jump in interest rates over the last year or two and worse cap rates that we’re seeing delinquency rates for multi-family properties nearing a relative, local high.

In some ways, it has been a perfect storm…

Keep reading with a 7-day free trial

Subscribe to Real Estate Financial Planner™ to keep reading this post and get 7 days of free access to the full post archives.