Sometimes it can be helpful to compare various loan programs and options simultaneously. For example, it could be useful to compare the monthly payment differences between various "nothing down," "low down," and full-size down payment options when buying a rental property.

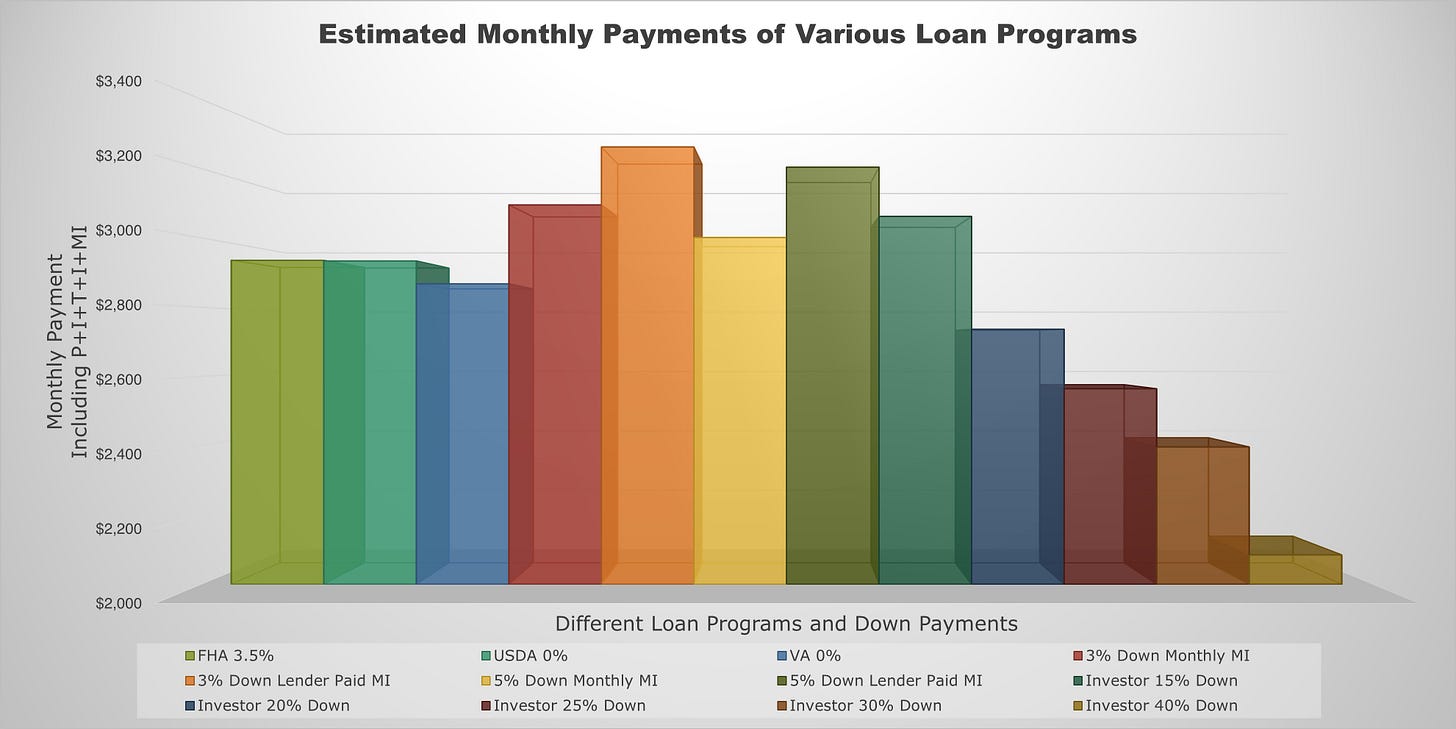

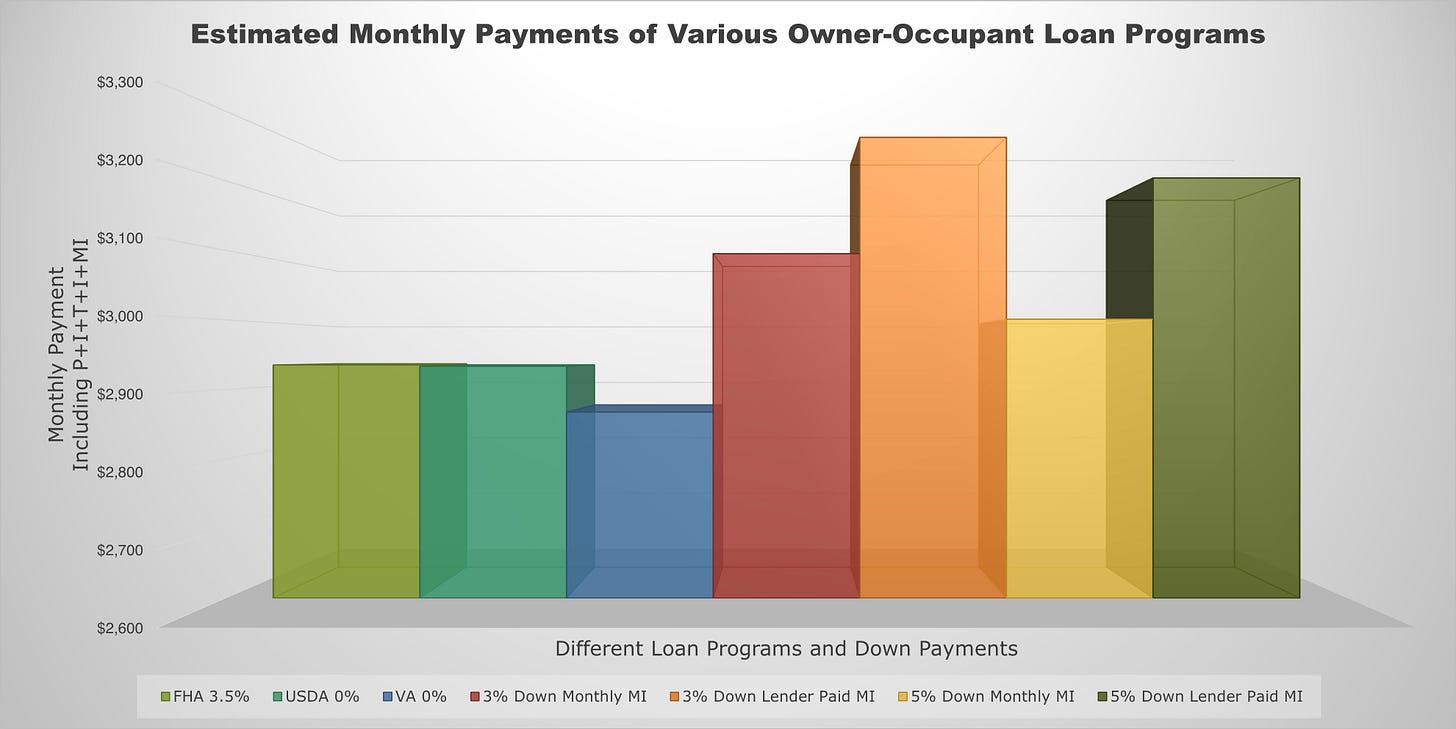

Visually seeing a chart comparing the monthly payments of your choices of loans can assist you in making better decisions.

If you had a spreadsheet to easily compare a variety of loan programs at the same time, it would be even more helpful. In this mini-class, James will share with you a loan comparison spreadsheet that allows you to easily compare all of the most common traditional financing options for real estate investors.

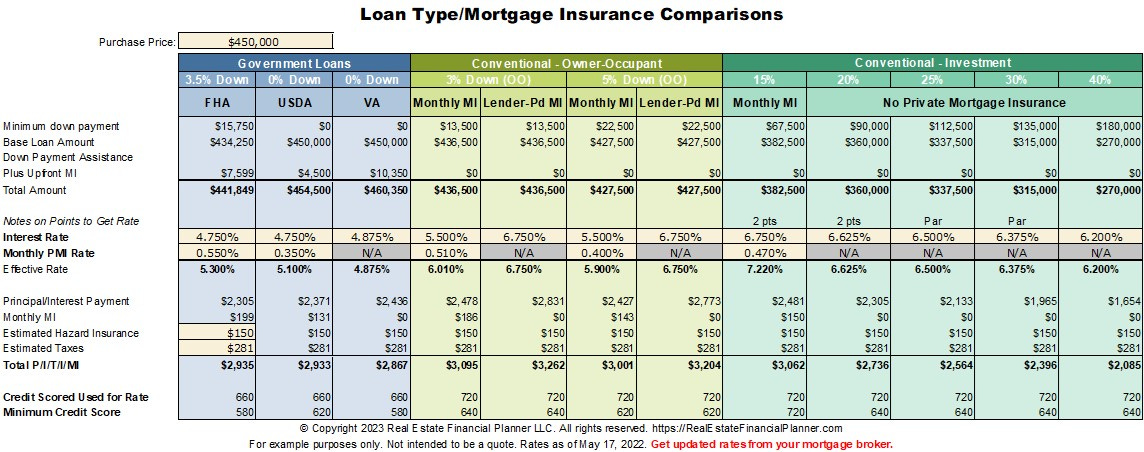

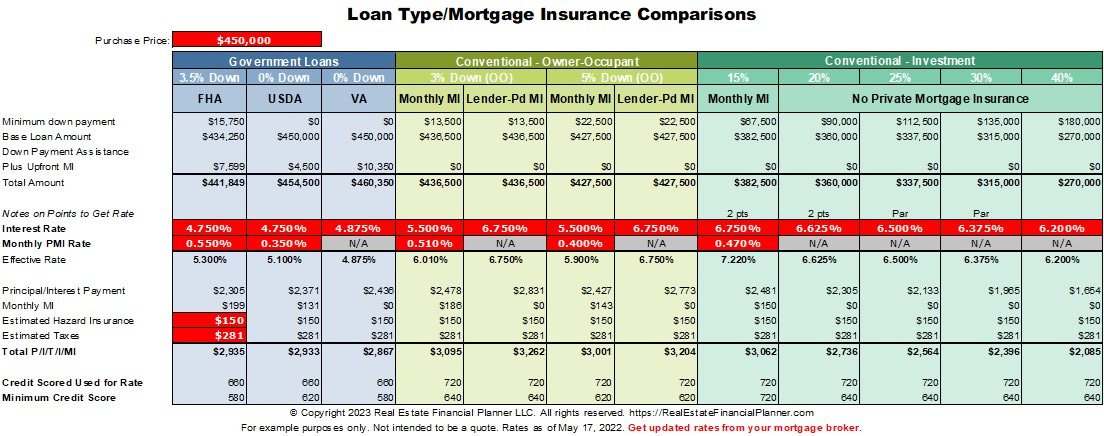

Loan Comparison Spreadsheet

Call your lender and get updated mortgage interest rates and private mortgage insurance rates for a variety of loan options based on your credit score and ability to qualify.

Most of the numbers you’ll input in the following areas highlighted in red but you can edit anything in the spreasheet:

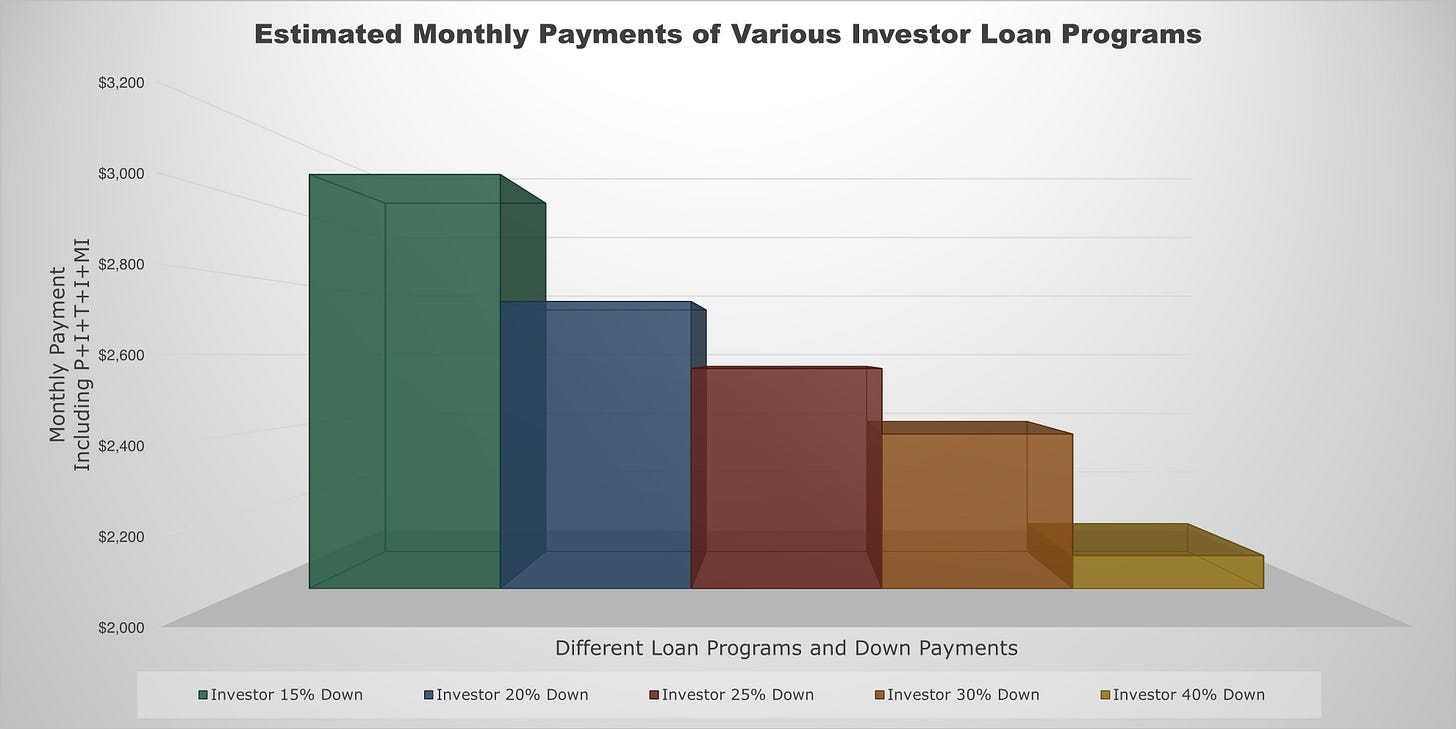

Then, compare various total monthly payments for each loan program.

For example, see the payments for all loans at a glance:

Or, just the owner-occupant ones if you’re planning to Nomad™ or house hack:

Or, just the non-owner-occupant ones if you’re buying an investment property and not moving in:

Download Loan Comparison Spreadsheet

Watch with a 7-day free trial

Subscribe to Real Estate Financial Planner™ to watch this video and get 7 days of free access to the full post archives.