What is the ideal down payment when purchasing a rental property?

While some real estate investors may barely scrape together the minimum down payment, there are advantages to putting down more. Additionally, changing your strategy to allow for a smaller down payment may also have advantages.

In this mini-class, James discusses how different down payment amounts can affect interest rates, overall return on investment, and changes you are likely to see in both interest rate and cash flow.

For example, here’s just one slide from the class recording below showing how returns can vary buying the same property but with different down payments (which means different interest rates and different PMI if less than 15% down payment).

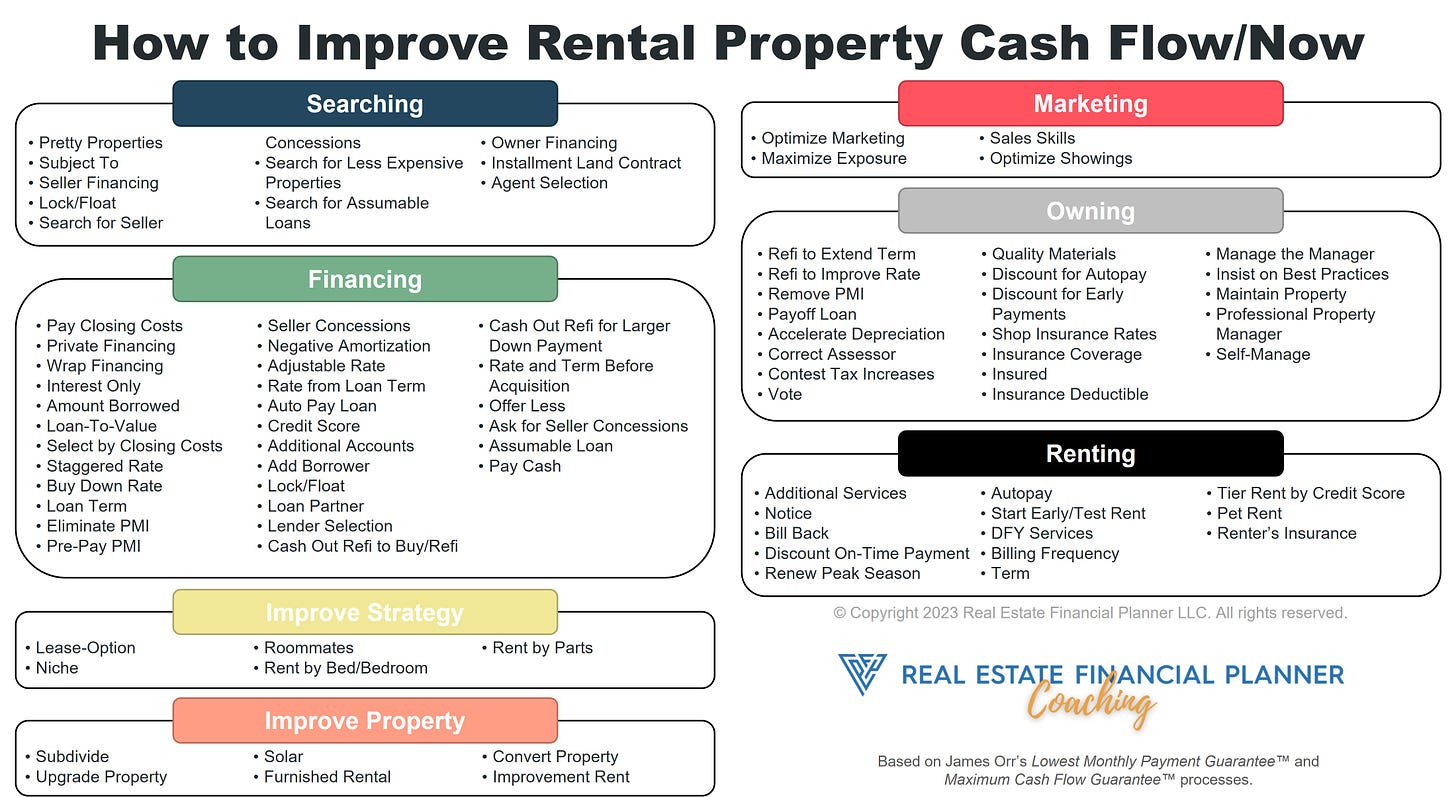

NOTE: We did not apply any of the 88 strategies to improve cash flow in this example property.

This will vary depending on your specific property, but the overall shape of how returns vary will likely be similar.

Watch with a 7-day free trial

Subscribe to Real Estate Financial Planner™ to watch this video and get 7 days of free access to the full post archives.