As you embark on buying your first investment property, establishing clear, written buying criteria is a crucial step. These criteria serve as your roadmap, guiding you toward properties that align with your investment goals and strategy.

Having well-defined, written criteria is important for several reasons:

Focus Your Search: Written criteria help you narrow down the vast pool of available properties to those that truly fit your investment strategy.

Consistency in Decision-Making: With clear guidelines, you're less likely to make emotional or impulsive decisions when evaluating properties.

Communicate Effectively: Written criteria allow you to clearly communicate your needs to real estate agents, lenders, and other professionals involved in your property search.

Measure Progress: By defining what you're looking for, you can more easily track how each potential property moves you closer to your financial independence goals.

Adapt and Refine: As you gain experience, you can adjust your criteria, creating a dynamic tool that evolves with your investment journey.

Your buying criteria should reflect your unique financial situation, risk tolerance, and long-term objectives. Let's explore how to develop criteria that will set you on the path to successful real estate investing.

Establishing Your Buying Criteria for Real Estate Investors

As you embark on your journey to buy your first investment property, establishing clear, written buying criteria is a crucial step. These criteria serve as your roadmap, guiding you towards properties that align with your investment goals and strategy.

Having well-defined, written criteria is important for several reasons:

Focus Your Search - Written criteria help you narrow down the vast pool of available properties to those that truly fit your investment strategy.

Consistency in Decision-Making - With clear guidelines, you're less likely to make emotional or impulsive decisions when evaluating properties.

Communicate Effectively - Written criteria allow you to clearly communicate your needs to real estate agents, lenders, and other professionals involved in your property search.

Measure Progress - By defining what you're looking for, you can more easily track how each potential property moves you closer to your financial independence goals.

Adapt and Refine - As you gain experience, you can adjust your criteria, creating a dynamic tool that evolves with your investment journey.

Remember, your buying criteria should reflect your unique financial situation, risk tolerance, and long-term objectives. Let's explore how to develop criteria that will set you on the path to successful real estate investing.

May Want Separate Criteria for Different Properties

Having separate, written criteria for each property or strategy you’d consider investing in can be beneficial.

Here's why:

Tailored Approach – Different property types and strategies require distinct considerations. What makes a single-family home a good investment might differ significantly from a multi-family or BRRRR property. Separate criteria allow you to address these specifics.

Aligned Goals – Every strategy serves a different goal. While a buy-and-hold strategy might focus on long-term cash flow, a fix-and-flip prioritizes short-term profit. Creating criteria for each property type ensures you're always working toward the correct objective.

Improved Decision-Making – With clear, strategy-specific criteria, you can more easily compare properties within the same category, making decision-making more straightforward.

Adaptability – As you gain experience with different property types or strategies, you can refine each set of criteria independently, allowing for more nuanced improvements over time.

Consider developing separate criteria for strategies such as:

Single Family Homes – Single family homes are different than multi-family properties so your criteria for them will likely be different.

Multi-Family 2-4 Units – Criteria for these properties might focus more on cash flow potential and, maybe the ability to live in one unit while renting out others (house hacking).

Commercial Multi-Family (5+ Units) – Your criteria for these will certainly differ than some of the other property types due to the nature of the properties.

House Hacking – Your criteria might prioritize properties with separate entrances and privacy features, which are key for living in part of the property while renting out the rest.

Nomad™ Strategy – Criteria should focus on properties that will make good primary residences but also work as rentals once you move to your next property.

BRRRR (Buy, Rehab, Rent, Refinance, Repeat) – These criteria might emphasize properties with significant renovation potential and strong after-repair value (ARV), along with cash flow projections. These can be some of the most difficult to find as you need both a discount and for them to be strong rentals.

Fix and Flip – Criteria might prioritize properties in desirable locations with potential for a high resale profit and speed of sale after renovations.

Wholesaling – This strategy might focus on finding properties with motivated sellers and below-market values to assign contracts to other investors.

Out-of-State Investing – These criteria may focus on finding strong cash flow, stable local economies, strong property management options, and a reliable rental market.

While having separate criteria for each strategy is valuable, this will primarily focus on criteria for buy-and-hold real estate investors, Nomads™, and house hackers.

You can adapt these principles to create criteria for other strategies as you expand your investment portfolio.

The Art of Selecting Your Buying Criteria

Selecting your buying criteria is a delicate balance between being specific enough to find properties that meet your investment goals and being flexible enough to not miss out on potential opportunities.

Here are some considerations related to that duality.

Narrow vs. Wide Criteria

Your criteria can range from very narrow to very wide:

Narrow Criteria - Being extremely specific might result in no properties matching your requirements. While this ensures you only see the most ideal properties, it may significantly limit your options. You might miss deals that would have worked for you but you missed because your filters were too strict upstream.

Wide Criteria - On the other hand, having very broad criteria might lead to an overwhelming number of properties to sift through, many of which may not be suitable for your investment strategy.

It's often beneficial to start with a wider net and gradually narrow it down as you gain more experience and clarity about what works best for your investment goals.

Time Horizon

Consider how long you're willing to search for a property:

Short-Term Search - If you need to find a property quickly, you might need to be more flexible with your criteria.

Long-Term Search - If you have the luxury of time, you can afford to be more selective, potentially setting criteria for only the most exceptional deals.

Quantity Needed

The number of properties you're looking to acquire affects your criteria:

Single Property - If you're only seeking one property, you can afford to have more stringent criteria, as you don't need multiple options to appear regularly.

Multiple Properties - If you're planning to build a portfolio on a timeline, you might need broader criteria to ensure a steady stream of potential investments.

Adapting to Market Realities

What if you can't find properties that match your criteria?

Back Testing - Ask your real estate agent to show you recent properties that partially match your criteria. Then do any additional analysis on these to see if there would have been ones that would have worked for you… and how many. This can help you understand if your expectations align with market realities.

Ongoing Dialogue - Maintain open communication with your agent about your criteria. Their market knowledge can be invaluable in refining your search parameters.

Flexibility - Be prepared to modify your criteria based on market feedback and the properties you view. Your ideal investment might look different in reality than it did on paper.

Remember, selecting your buying criteria is not a one-time event.

It's an evolving process that will likely change as you gain more experience and insight into the real estate market.

Stay open to adjusting your criteria as you learn more about what works best for your investment strategy.

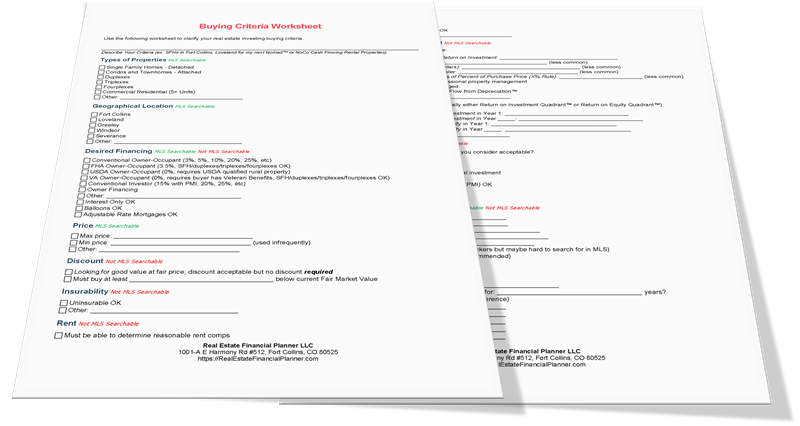

MLS Searchable or Not

When establishing your buying criteria, it's crucial to understand which criteria can be easily searched in the Multiple Listing Service (MLS) and which require manual analysis. This understanding will help you streamline your property search process and ensure you're not missing out on potential opportunities.

MLS Searchable Criteria

These are criteria that can typically be filtered directly in the MLS search tools:

Price Range - You can set minimum and maximum price points.

Location - This includes specific neighborhoods, zip codes, or areas within certain boundaries.

Property Type - Such as single-family homes, duplexes, or multi-family units.

Number of Bedrooms and Bathrooms - You can specify minimum requirements.

Square Footage - Both for the house and the lot.

Year Built - You can set ranges for the age of the property.

Specific Features - Like garage spaces, pool, or central air conditioning.

These criteria allow you to quickly narrow down the vast pool of available properties to those that meet your basic requirements.

Not MLS Searchable Criteria

These criteria typically require manual analysis or additional tools:

Cash Flow Potential - This requires individual analysis of each property's income and expenses.

Cap Rate - You'll need to calculate this based on the property's net operating income and purchase price.

Cash-on-Cash Return - This involves considering your initial investment and the property's annual cash flow.

BRRRR Potential - Identifying properties suitable for the Buy, Rehab, Rent, Refinance, Repeat strategy requires individual assessment.

Fix and Flip Opportunities - These often need on-site evaluation to determine renovation potential and costs.

Financing Options - While some MLSs may have fields for seller financing, most financing considerations aren't searchable.

House Hack Suitability - Beyond basic multi-unit searches, identifying ideal house hack properties often requires individual evaluation.

For these criteria, you'll need to review properties individually or use additional analysis tools like The World's Greatest Real Estate Deal Analysis Spreadsheet™ to determine if they meet your investment goals.

Balancing MLS Searchable and Non-Searchable Criteria

To optimize your property search:

Start Broad - Use MLS searchable criteria to create an initial list of potential properties.

Refine Manually - Apply your non-MLS searchable criteria to this list to identify the best opportunities.

Stay Flexible - Remember that overly restrictive MLS searches might cause you to miss good opportunities due to data entry errors or unique property characteristics.

Communicate with Your Agent - Ensure your real estate agent understands both your MLS searchable and non-searchable criteria to help identify properties that might not perfectly fit your search parameters but could still be excellent investments.

By understanding the limitations of MLS searches and incorporating manual analysis, you'll be better equipped to find properties that truly align with your investment strategy and goals.

From “Millionaire Real Estate Investor”

In their book "Millionaire Real Estate Investor," Gary Keller, Dave Jenks, and Jay Papasan present a valuable chart that discusses where good and great deals can be found based on four key criteria:

Cash Flow - The likely cash flow produced after all expenses.

Hassle - The time and work involved in dealing with typical tenants in that price range.

Appreciation - The likely appreciation of the property over time.

Liquidity - How quickly you might be able to sell the property.

According to their analysis, the sweet spot for real estate investments is in the "low end of the middle" of the market. This area can be described as the second quartile of properties, typically below the median (50th percentile) of property prices in your market, but above the bottom 25th percentile.

This strategy aims to avoid the least expensive properties, which often come with the highest hassles, while still capturing good opportunities for cash flow, appreciation, and liquidity. By focusing on this range, investors can potentially find a balance between affordability and quality, minimizing management headaches while still achieving solid returns.

Type of Property and Number of Units

When considering the type of property and number of units as buying criteria for your first investment property, it’s important to understand how these factors can impact your investment strategy, financing options, and overall management responsibilities.

This criteria is MLS Searchable, meaning your real estate agent can easily filter properties based on these specifications.

Single Family Homes

Attached/Detached/Either – Decide if you prefer standalone houses, condos, townhomes, or if you're open to any of these options.

Owner-Occupant Financing – For Nomads™ and house hackers, this can include 0% down (VA loans), 3% down (some conventional loans), 3.5% down (FHA loans), or 5% down (conventional loans).

Investor Financing – Typically requires 15% down with Private Mortgage Insurance (PMI) or 20-25% down without PMI.

Duplexes, Triplexes, and Fourplexes

Low Down-Payment Advantages – Nomads™ and house hackers can still benefit from owner-occupant financing options like VA, FHA, or conventional loans.

Non-Owner-Occupant Financing – Usually requires 25% down with conventional loans.

Five Units or More

Financing Limitations – Owner-occupant financing is no longer available for properties with five or more units.

Commercial Financing – These properties typically require commercial loans, which are more likely to have adjustable rates (ARMs) and/or balloon payments.

Location

When considering the location of your first investment property, it’s essential to define clear criteria based on your investment goals. Location can significantly impact factors like tenant demand, rental income, and property appreciation. Fortunately, this is MLS Searchable, meaning your real estate agent can filter properties based on your location preferences.

What Locations Are Acceptable?

You’ll need to decide which areas are ideal for your investment. This will depend on factors like proximity to amenities, employment centers, or specific school districts. Here are some common ways to define location criteria:

Specific County or Combination of Counties – You can focus on one or more counties that you believe will have strong rental demand or appreciation potential.

Specific City or Combination of Cities – Choose cities where you’re confident in the rental market or have personal knowledge of the area.

Proximity to Major Landmarks – You might want properties within a certain distance from a major university, large employer, or a hospital. These locations often have steady rental demand from students or employees.

Specific School District – Targeting a specific school district could help attract families and increase tenant stability.

Pre-Defined Shape on a Map – You can get as specific as drawing a boundary on a map, such as: "south of this street, north of that street, and between two other boundaries." This is useful when you want to focus on a particular neighborhood or development.

When defining your location criteria, make sure it aligns with your investment strategy. If you’re house hacking, you may want to stay close to work or family. If you’re targeting rental properties, consider areas with high rental demand and potential for appreciation. Location plays a crucial role in your long-term success as a real estate investor.

How Are You Going to Finance the Property?

Financing is an important part of selecting your first investment property.

The loan you choose affects both the properties you can afford and your long-term investment strategy.

MLS Searchable vs. Non-Searchable Financing Options

Some MLS systems allow you to search for properties based on certain financing options, but this can vary. Even if available, the information may not always be accurate due to data entry errors.

MLS Searchable – Financing options like FHA (Federal Housing Administration) or VA (Veterans Affairs) loans may be searchable in the MLS. However, not all listings have this information, and it’s not always reliable.

Non-MLS Searchable – Other financing options, like USDA loans or owner financing, are often not searchable in the MLS. For these, you’ll need to do manual research or inquire directly.

Your MLS may be different so discuss what is available in your MLS with your real estate agent.

Types of Financing to Consider

USDA Loans – These loans offer zero down payment but are limited to properties in USDA-designated rural areas within specific price limits. Check the USDA eligibility website or consult your lender to confirm a property's qualification—don't rely on the seller's word.

FHA or VA Loans – FHA loans require a 3.5% down payment, while VA loans offer 0% down for eligible veterans. Both require properties to meet health and safety standards, potentially excluding fixer-uppers. For rehab properties, consider the FHA 203K loan program, which allows you to include renovation costs in your FHA loan.

Conventional Financing – This traditional mortgage option typically requires a higher down payment but offers more flexibility in property choice and potentially lower overall costs.

Owner Financing – This can be an attractive alternative to traditional lenders. You'll need to directly ask the seller about this option, as it's rarely indicated in MLS searches.

How Financing Impacts Your Strategy

Choosing the right financing affects both your current deal and your future investment opportunities.

Can I Get Reasonable Financing? – Ensure the loan terms make sense for your cash flow and overall financial goals. Watch out for high-interest loans or restrictive terms that could hinder your returns.

Will Financing Limit Future Purchases? – Some loans may prevent you from qualifying for additional properties until your financial situation improves. Make sure the property you’re financing is the right one if you’re limited in how many you can buy in the near future.

Is This Financing Adding Risk? – Be cautious of loan structures with adjustable rates (ARMs) or balloon payments, which could introduce additional risk to your investment over time.

Including financing in your buying criteria helps you focus on properties that fit both your short-term and long-term financial goals, ensuring a smarter investment strategy.

Price

This criterion is one of the most common MLS searchable fields, which means your real estate agent can easily filter properties based on your specified price range.

When determining your price range, consider the following factors:

Maximum Price - Establish the highest price you're willing to pay. This should align with your financial capabilities and investment goals.

Minimum Price - While it might seem counterintuitive, setting a minimum price can help you avoid properties that may require extensive repairs or are in less desirable areas. Although you might miss a deal you would consider if you set it too low. It is a trade-off of having to manually eliminate properties versus making the number you need to manually look at more reasonable.

Lender Qualification - Ensure you're pre-qualified for a loan that covers your maximum price.

Down Payment - Calculate the down payment required for your price range. Remember, this can vary based on the type of loan you're using.

Closing Costs - If you’re using the cash you have on hand into what price you can go up to, make sure you factor in closing costs.

Rent Ready Costs - Budget for any immediate repairs or upgrades needed to make the property ready for tenants.

Negative Cash Flow - If applicable, account for potential negative cash flow in the early stages of your investment. More on this in a bit.

Reserves - Ensure you have adequate reserves for buying this property as well.

When setting your price range in certain market conditions, it might make sense to leave some room for negotiation. You might want to set your maximum price slightly higher than your ideal purchase price to account for this.

Ask yourself: If the perfect property came along but was $10,000 over your limit, would you consider it? If so, your maximum price might be more of a guideline than a hard rule.

Discount

Keep reading with a 7-day free trial

Subscribe to Real Estate Financial Planner™ to keep reading this post and get 7 days of free access to the full post archives.