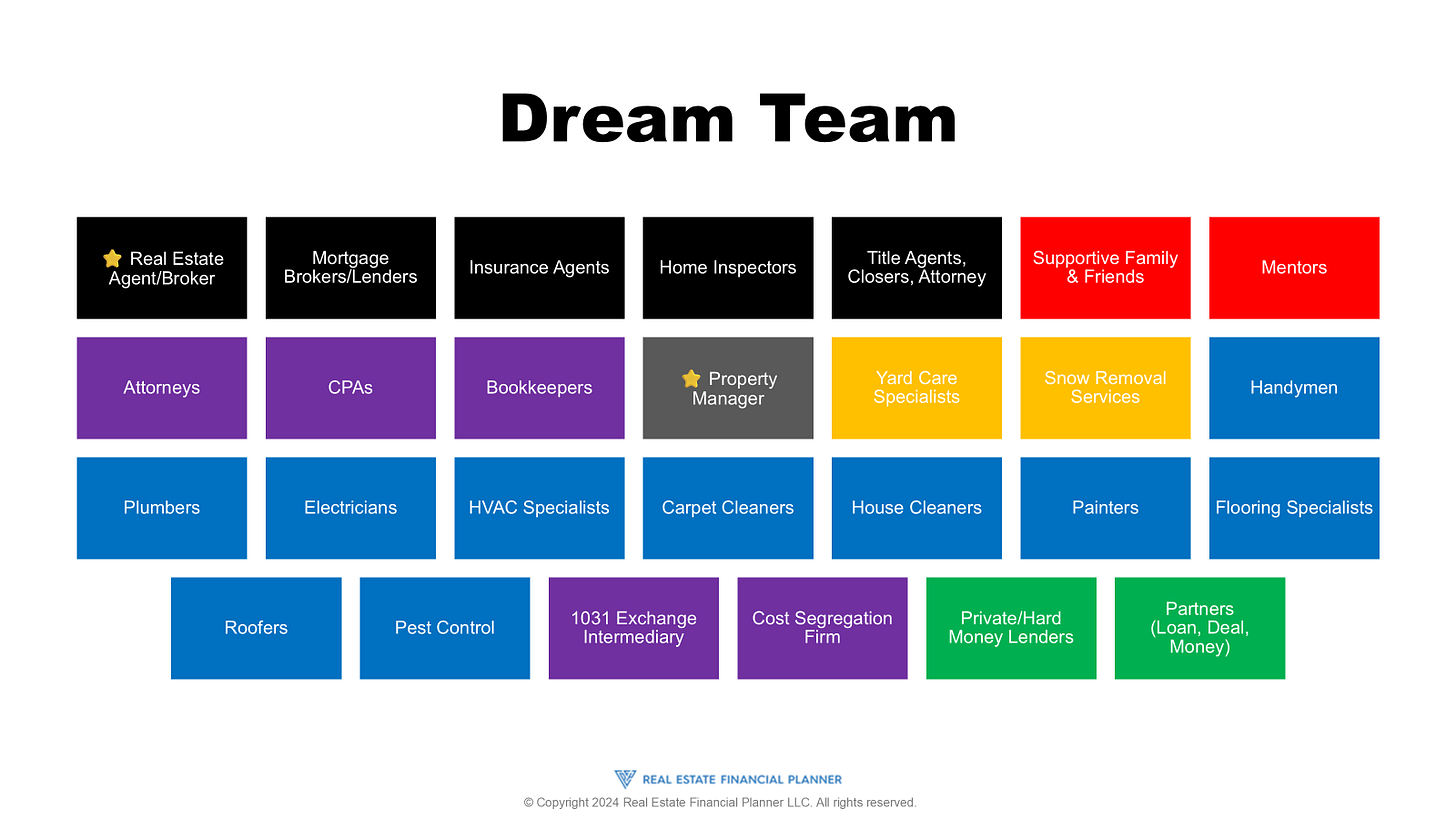

When you're building your real estate investing dream team, the first person you should focus on finding is your real estate agent or broker.

We've already covered the details of selecting an investor-friendly agent, but this step is critical because your agent will often act as the cornerstone for building the rest of your team.

Your real estate agent will usually be able to lead you to your other dream team members. While you can also get referrals from other real estate investors you meet or from dream team members themselves, your agent is typically your best starting point.

Unless I call it out specifically, you should rely on your real estate agent to refer you to all the dream team members before the sale, and then both your real estate agent and your property manager for the dream team members you'll need after your purchase.

⭐ Real Estate Agent/Broker

Your real estate agent or broker is one of the most important members of your real estate investing dream team, especially when you're buying your first investment property. Selecting an investor-friendly agent is critical because they will often act as the cornerstone for building the rest of your team.

Your real estate agent will usually be able to lead you to your other dream team members. While you can also get referrals from other real estate investors you meet or from dream team members themselves, your agent is typically your best starting point.

Unless I call it out specifically, you should rely on your real estate agent to refer you to all the dream team members before the sale, and then both your real estate agent and your property manager for the dream team members you'll need after your purchase.

Mortgage Brokers/Lenders

Mortgage brokers or lenders are one of the most important members of your real estate investing dream team when buying your first investment property. They play a crucial role in helping you secure financing for your deal.

What Do They Do?

A mortgage broker or lender’s main job is to connect you with financing that suits your investment strategy and financial situation. Mortgage brokers work as intermediaries between you and a variety of potential lenders, helping you shop around for the best loan terms, including interest rates, down payments, and loan types.

Lenders, on the other hand, are institutions (like banks or credit unions) that provide the actual loan themselves.

Here’s what a mortgage broker or lender typically handles:

Evaluating Your Financial Situation – They will review your credit score, income, debt-to-income ratio, and other factors to determine your eligibility for a loan.

Presenting Loan Options – Brokers present multiple loan options from various lenders, while lenders present the loan options they offer directly.

Securing Pre-Approval – They can help you get pre-approved for a mortgage, which strengthens your offers when you make offers on properties.

Coordinating with the Appraiser – Once you’re under contract, the lender selects and coordinates with the appraiser to determine the property’s value.

Finalizing Loan Terms – They help lock in your interest rate and loan terms, so you know what to expect at closing.

Overseeing the Loan Process – Brokers and lenders guide you through the loan process from pre-approval to closing, ensuring all paperwork is in order and you meet deadlines.

In addition, your mortgage broker can provide information about buying down your mortgage interest rate, which is an important tool for real estate investors to improve cash flow. By paying points upfront, you can lower your monthly payments, which might improve your cash flow. A good broker can help you run the numbers, comparing different options to see whether buying down your rate will save you money in the long run and if it aligns with your investment strategy.

When Do You Involve Them?

You’ll want to bring your mortgage broker or lender into the picture as soon as you start seriously considering buying your first investment property. Ideally, this happens before you start making offers. Early involvement helps you understand your budget, the loan options available to you, and allows you to secure pre-approval. Having pre-approval is especially important in competitive markets where sellers favor buyers who already have their financing lined up.

You will work closely with your broker or lender throughout the transaction, from pre-approval to closing. They will keep you updated on your loan’s status, and help you gather and submit required documents, like bank statements, tax returns, and pay stubs.

Why Are They Important?

The terms of your loan—especially the interest rate, down payment, and fees—directly impact your cash flow, the overall profitability of the investment, and your long-term ability to scale your portfolio.

A good mortgage broker or lender will help you get the best possible terms for your financial situation and investment goals, saving you money in both the short and long term. And, they’ll help ensure your financing plan aligns with your real estate investing goals and plan to be financially independent.

Here’s why they are so critical:

Access to Loan Products – A mortgage broker can offer a wider range of loan products than a single lender, which is helpful if you’re looking for something specific for a particular strategy or situation.

Knowledge of Investor-Specific Loans – They can also guide you through investor-specific loan products, like loans for multi-family properties, BRRRR, flipping, house hacking, or loans tailored to those looking to scale quickly.

Pre-Approval Advantage – A pre-approval letter makes you more competitive in the eyes of sellers, which is especially important in hot real estate markets.

Mortgage brokers don’t just help you buy properties—they can also help you optimize financing after you own your rental portfolio. If you decide to refinance to pull cash out for additional investments, or if interest rates drop and it makes sense to reduce your monthly payments, your mortgage broker can guide you through a cash-out refinance or a rate-and-term refinance. They can help you compare options and decide which route will best serve your goals as a real estate investor.

Other Items of Note

Appraisers – As mentioned, your lender will select an appraiser to assess the property’s value. You’ll typically pay for the appraisal either upfront or as a line item on the closing statement.

Loan Fees – Be aware of the various fees associated with your loan, including origination fees, appraisal fees, and closing costs. Your mortgage broker or lender should provide a loan estimate early in the process, which will break down all these costs.

Working with Investors – Not all mortgage brokers and lenders are familiar with the needs of real estate investors. Make sure you’re working with someone who understands investor-specific concerns, such as ensuring cash flow on rental properties and knowing the different lending guidelines for investment properties compared to primary residences.

Insurance Agents

Insurance agents are an important part of your real estate investing dream team because they help you secure the right coverage to protect your investment. While they often come into play closer to the end of your property purchase, selecting a good insurance agent early in the process is key to making sure your assets are protected from day one and can help you with having appropriate numbers when analyzing potential deals.

What Do They Do?

Insurance agents work to find the best coverage to protect your property from risks such as damage, liability claims, and natural disasters. As a real estate investor, you need policies tailored to rental properties, which differ from standard homeowner policies.

In addition to property coverage, they may also recommend umbrella policies to protect your assets in general—regardless of whether you own properties.

Here’s what an insurance agent typically handles:

Evaluating Property Risks – They assess factors like location, property type, and usage to recommend the right insurance policies.

Recommending Insurance Policies – They guide you through options such as landlord insurance, liability coverage, and umbrella policies, ensuring your assets are adequately protected.

Providing Quotes – They offer quotes based on the property and coverage you need. These quotes will help you plan for your deal analysis and give you realistic numbers to factor into your cash flow projections. It is not about getting the lowest rate. Sometimes it makes sense to pay a little more to get better coverage.

Assisting with Claims – If your property suffers damage, the insurance agent helps you file claims and ensures you receive the compensation needed to repair or replace the property.

Additionally, your mortgage broker can be a great source for insurance agent referrals in addition to your real estate agent. Since your mortgage broker regularly sees a variety of insurance quotes when helping clients close deals, they may know which agents consistently provide low rates. While you need to compare the actual coverage provided for those rates, this can give you a good starting point. A mortgage broker who takes the time to look at insurance policies is a valuable resource when selecting an insurance agent.

When Do You Involve Them?

You’ll typically need to secure an insurance policy once you’re under contract and preparing to close. Lenders will require proof of insurance before they fund the loan, but you won’t need to purchase the policy until the property is officially yours—usually at closing.

However, it’s smart to reach out to an insurance agent earlier, before you start analyzing deals. By getting a quote for a typical property you're considering, you can use realistic insurance costs in your deal analysis. This gives you a clearer picture of how the property will perform financially. You don’t need to call your agent for every potential deal—just adjust your analysis up or down depending on the price of the property you’re analyzing based on the initial quote.

You can get a firmer insurance quote—and verify your assumptions—when you get more serious about a particular property.

For investors who want broader protection for their assets, it might also be worth considering umbrella insurance even before purchasing any property. Umbrella policies provide higher levels of liability protection beyond what your standard policies offer. Depending on your financial situation, you might benefit from an umbrella policy even before owning rental properties, and your insurance agent, CPA, and attorney can help you decide if this makes sense for your situation.

In general, if you have assets to lose, then an umbrella policy to protect those assets may make sense.

Why Are They Important?

Insurance is a foundational component of your asset protection plan as a real estate investor. The right coverage can protect you from unexpected costs due to natural disasters, fires, or liability claims. Without proper insurance, a single incident could result in significant financial loss.

Here’s why having a good insurance agent on your dream team is critical:

Property Protection – They ensure you have the appropriate coverage for physical damage and repairs.

Liability Coverage – They recommend liability policies to protect you from lawsuits and other claims.

Umbrella Protection – Umbrella policies extend your coverage, protecting you and your assets beyond the limits of your specific automobile and property policies.

Other Items of Note

Umbrella Policies – Umbrella policies are designed to protect your personal assets from higher-level liability risks, such as lawsuits that exceed the limits of your existing coverage for your automobile and property policies.

Working with Your Team – Insurance should be considered in the broader context of your asset protection strategy. Work with your insurance agent, CPA, and attorney to ensure that all parts of your financial and legal protection are aligned and provide comprehensive coverage.

Home Inspectors

Home inspectors are a key part of your real estate investing dream team, but it’s important to remember that they are a due diligence cost. You pay them for the inspection whether you end up buying the property or not.

In some cases, you might pay for inspections on several properties before you find one that meets your criteria.

What Do They Do?

Home inspectors thoroughly examine the condition of a property to identify any potential issues. Their goal is to give you a comprehensive understanding of the property’s condition before you commit to buying it. While they don’t fix issues or guarantee that nothing will go wrong, their report provides you with valuable insights.

Here’s what they typically handle:

Examining the Structure – They assess the foundation, walls, roof, and other structural elements that are visible to check for any major defects.

Inspecting Major Systems – They check the plumbing, electrical, and HVAC systems to make sure they are functioning properly.

Identifying Safety Concerns – They look for issues like faulty wiring, mold, or other hazards that could pose risks to occupants.

Providing a Report – After the inspection, they provide a detailed report outlining any concerns and recommending repairs.

It’s also worth noting that home inspectors are human, have limited access to inspect inaccessible aspects of the properties (like things behind walls), and can miss things. They aren’t perfect. Their liability for missing major issues is often limited to the amount you paid them for the inspection. Understanding the terms of their contract and what recourse you have if something is missed is important.

Some issues may also be out of their control; for example, they might not be able to inspect a roof thoroughly if it's covered in snow.

When Do You Involve Them?

You hire the home inspector once your offer has been accepted and you’re in the due diligence phase of the transaction. The inspection should happen early in this period—look at the dates and deadlines of your contract with your real estate agent—so that you have time to review the report and decide whether to move forward with the purchase or negotiate repairs with the seller.

Since you’ll pay for the inspection whether you buy the property or not, this is part of the upfront cost of evaluating potential properties. In some cases, you may have to inspect several properties before closing on one.

In other cases—like very competitive, extreme seller’s markets—you may choose to accept additional risk and waive your rights to inspect the property to get your offer accepted. Or, pay to have an inspector join you while looking at that property before you make your offer.

Why Are They Important?

Home inspectors help you uncover potential issues that could affect the value or safety of the property. They provide peace of mind by helping you avoid unexpected repairs that could eat into your cash flow or force you to spend more than you anticipated after closing.

Here’s why they’re crucial:

Uncovering Hidden Problems – Their inspection can reveal issues like structural damage, electrical problems, or leaks that you wouldn’t otherwise notice during a walkthrough.

Informing Your Investment Decision – The inspection report gives you critical information to help you make a more informed decision about whether to proceed with the purchase.

Negotiating Power – If significant issues are uncovered, you can use the report to negotiate repairs or ask for a reduction in the purchase price.

Following the Inspection

It’s a good idea to follow the inspector around as they go through the property. This helps you in several ways:

Learn What to Look For – Watching the inspector will teach you what to check on future properties, so you can spot potential problems before you even make an offer.

Get a Better Understanding of the Property – They can show you important features like shut-off valves, access to crawl spaces, potential weak points of the property—like poor drainage or ventilation to keep an eye on—and other things that you’ll need to know as the owner.

Get Additional Information – By being present, you can ask questions in real-time and gain insights that might not make it into the formal report. These can be valuable on this property and future properties.

Clarify Costs – While some inspectors may offer rough estimates on repair costs, take these with skepticism. Not all inspectors will have an accurate idea of what it will cost to fix the problems they identify, so use their estimates as a starting point, but get professional quotes for significant repairs.

I like to think of shadowing the inspector as mentoring you’re getting for the hour or two when you hire them to do the inspection.

Home Warranty Option

If your home inspector notes that certain items—such as the furnace, water heater, or major appliances—are nearing the end of their useful life, you might consider purchasing a home warranty from a home warranty company.

A home warranty is a separate insurance policy that covers things like appliances, HVAC systems, and plumbing, providing a safety net in case something breaks down soon after you take ownership. This can be a valuable layer of protection, especially if the inspector highlights items that are likely to need repair or replacement soon.

The warranty can help reduce your financial risk and give you peace of mind, particularly during the first few years of owning the property.

Other Items of Note

Limitations of Inspections – There may be situations where the inspector is limited in what they can check. For instance, if there’s snow on the roof or the attic is inaccessible, they may not be able to fully inspect those areas.

Specialized Inspections – If the general inspection reveals potential concerns, such as termite damage or mold, you may need to bring in specialists for additional inspections. Be prepared for these added costs during the due diligence period.

Re-Inspections – If you negotiate repairs with the seller, you may want to hire the inspector for a re-inspection to confirm that the work was completed properly. Be sure to include this right and the right to object again if it was not done correctly in your contract when you object to issues found on the inspection. You’ll often need to direct your real estate agent to do this as it may not be automatic.

Surveyors

Surveyors are an important part of your real estate investing dream team, though you might not always need them for every deal.

What Do They Do?

Keep reading with a 7-day free trial

Subscribe to Real Estate Financial Planner™ to keep reading this post and get 7 days of free access to the full post archives.