I recorded the introduction to the new Real Estate Financial Planner™ Coaching I am about to release to help real estate investors that are looking to buy a rental property in the next 90 days… and maximize cash flow… even though prices are high, interest rates are high and rents are lagging.

In the introduction, I talked about the 7 steps that every real estate investor should go through when buying a rental property… even though few do.

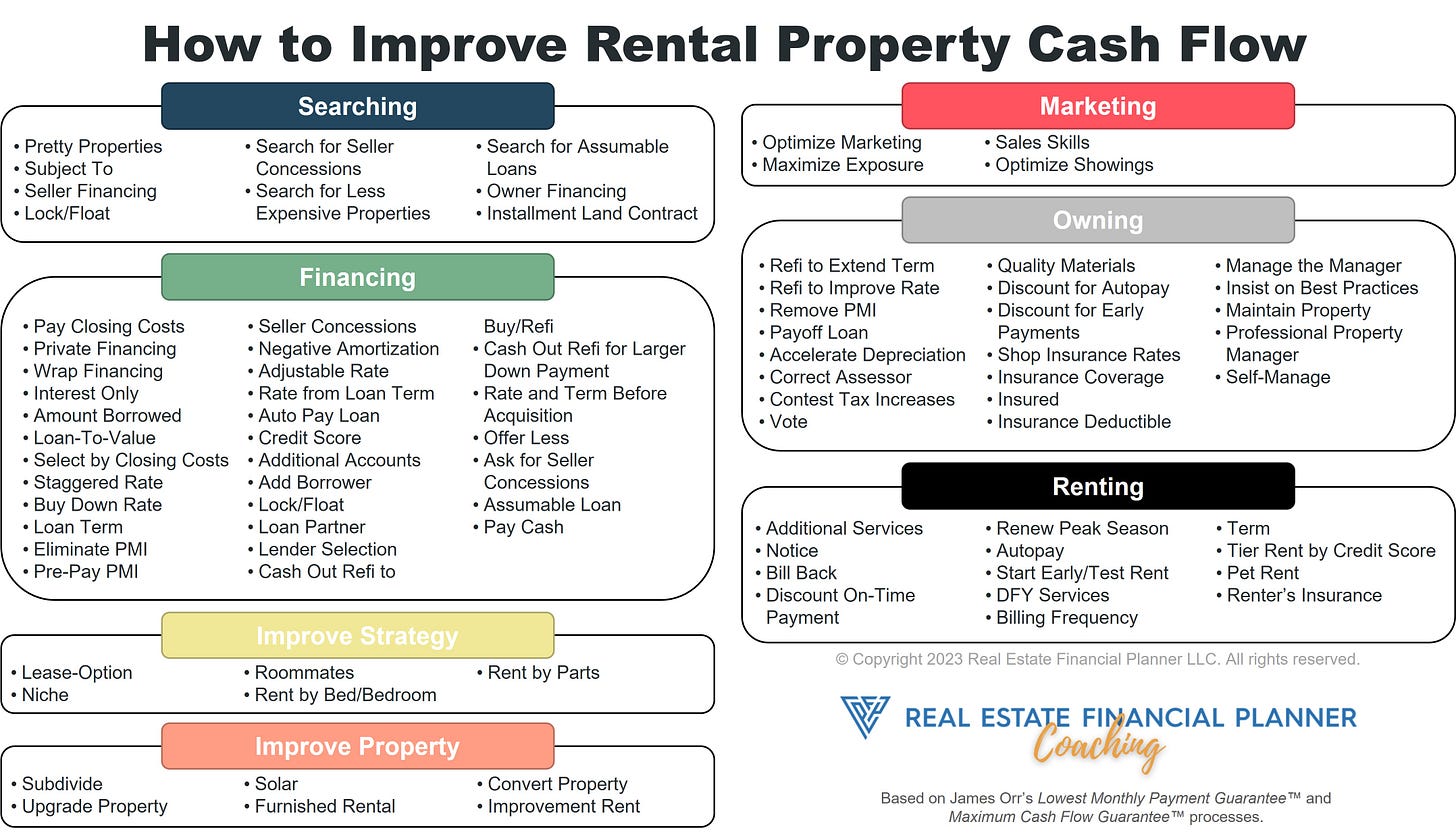

As you go through each step… we should be optimizing for minimizing expenses and maximizing income to get the best cash flow possible (see infographic below for an idea of what we cover in detail in coaching broken out by stage).

7 Steps to Buying a Rental Property

Back to the 7 steps… the 7 steps are:

Determine what financial independence looks like for you. Get clarity on whether buying this particular rental property moves you toward achieving your specific vision of what financial independence is.

Determine which real estate investing strategy will get you there. Once you know what financial independence looks like, determine if the strategy you’re using will get you there or if you need to tweak the strategy to get you there faster, safer and with more profit/at a higher standard of living.

Determine how you will fund (down payment) and finance the purchase (and consider future purchases). What is your source of down payments? What type of financing will you use—traditional financing like conventional loans, FHA, VA, USDA or creative financing like owner financing, subject-to, lease-options, etc.

Determine who’s on your Dream Team and the roles for each. What are you supposed to be doing. What does your agent do? Your lender? Your property manager (or you if you’re doing it yourself?

Understand returns and deal analysis. Understand the returns and how they get you to financial independence. Also understand how to analyze deals using The World’s Greatest Real Estate Deal Analysis Spreadsheet™ and how to manipulate returns with Deal Alchemy™.

Optimize for Cash Flow and Cash Now. Use the Lowest Monthly Payment Guarantee™ and Maximum Cash Flow Guarantee™ to make sure you are getting the very best cash flow and cash now on this property you’re buying. You can also use these on other properties you already own and ones you might buy in the future.

Understand, measure and mitigate risks. It is not enough to acquire the property and let risk grow out of control… you must understand, measure and mitigate risks while optimizing for your desired return.

While this is primarily for the new coaching program, I will post the intro video below for our paid subscribers.

Keep reading with a 7-day free trial

Subscribe to Real Estate Financial Planner™ to keep reading this post and get 7 days of free access to the full post archives.